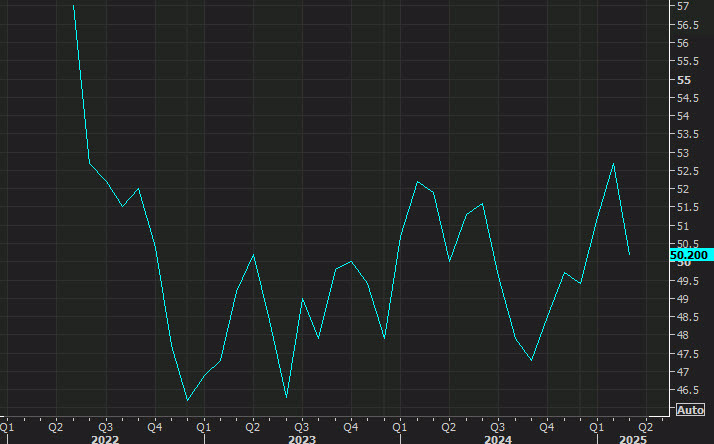

- Prelim was 50.7

- Prior was 50.2

- Panelists noted an increased apprehension in product markets, mainly around the future direction of US trade policy

- Business confidence at 10 month low

- stocks of finished goods were reduced for a fifth month in a row, and to the greatest degree of the year so far

I'm surprised that inventories have been drawn down so deeply and it points to a rough hit from shortages than anticipated, and sooner.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

"Manufacturing continued to flat-line in April amid worrying downside risks to the outlook and sharply rising costs. "Factory output fell for a second successive month as tariffs were widely blamed on a slump in export orders and curbed spending among customers more broadly amid rising uncertainty. "Although the survey saw some producers report evidence of beneficial tariff-related switching of customer demand away from imports, any such sales increase was countered by worries over tariff-related disruptions to supply chains and lost export sales. This served to drive business confidence about prospects in the year ahead down sharply to the gloomiest for 10 months. "Concerns have also spiked in terms of input costs, especially for imported materials and components, due to the triple whammy of tariff-related price hikes, supply shortages, and the weaker dollar. "Manufacturers are responding to these changing demand, supply and cost conditions by raising their selling prices and trimming headcounts to help protect their margins."