The dollar is weaker across the board today, extending losses from Monday with USD/JPY eyeing a third consecutive daily decline. It's a bit of a mixed bag this week with precious metals taking a breather, while stocks and bond yields were dragged down by the softer US retail sales data yesterday here.

In continuing with the more hectic US economic calendar this week, today will feature the biggest one yet in the labour market report.

All eyes are on the jobs data and market players are waiting on the sidelines to play the reaction to that. It's been the main anticipation all week already. And the reaction will largely be all about the Fed outlook and what the central bank will do next.

As things stand, traders are pricing in ~60 bps of rate cuts by the Fed for this year. And the next full 25 bps rate cut is priced in for the June meeting. Naturally, the softer consumer picture presented yesterday reinforces this pricing.

If we do see a stronger non-farm payrolls print and steadier unemployment figures, it's an indication that the Fed might stay on hold for longer.

At best, it could significantly lessen the risks of a rate cut in the first half of the year. But given the mixed picture from the US consumer yesterday, it would be too early to dismiss the case of there being no more rate cuts in June or July.

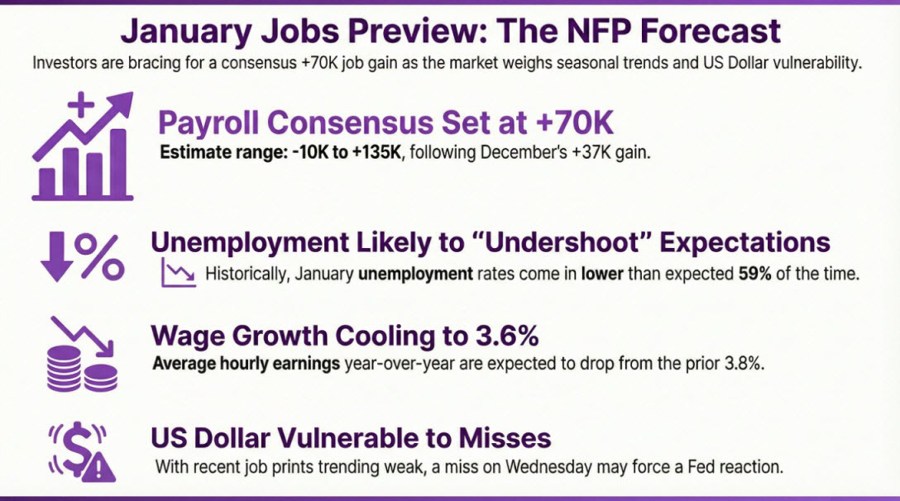

After all, the labour market picture is still on a weakening trend as a whole. Even though the non-farm payrolls consensus is pointing to a jobs growth of 70k today, one data point doesn't make a trend. So, I reckon that will limit any talks of the Fed being more hawkish or bullish about the economy.

At the most, it will keep them in a neutral position but still with a slightly dovish lean. That because if the jobs data is weak again today, expect markets to quickly want to pressure the Fed into cutting even earlier than June.

With equities looking wobbly in recent weeks, it wouldn't be surprising to see investors start kicking and screaming in wanting the Fed to pacify them before being hurt further. So, therein lies the balance of risks for markets.

In looking to the job numbers today, there is an interesting statistical tidbit from Revelio Labs here:

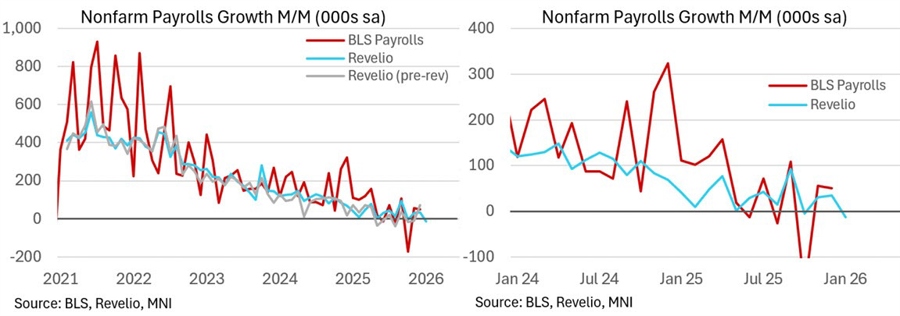

Their estimate of non-farm payrolls to start the new year is for a contraction of 13.3k in January, with a marked revision to the December figure to 34.4k (down from 71.1k).

This is not an official "estimate" of the non-farm payrolls but is an indicative measure of the overall trend. Revelio Labs' measure is "a set of employment statistics derived from over 100 million professional profiles sourced from professional networking websites", such as LinkedIn etc.

Their methodology feels rather roguish but it does seem to provide a good indication of the labour market trend in general (h/t @ MNI):

So even with no negative print today in all likelihood, the trend is clear in that the labour market picture is weakening. And the payrolls figure will continue to reflect that over time with the economy in its current state.

That will serve as a reminder that one data point does not make a trend, in sizing up any market reaction to the report later.