The FOMC enters the blackout period tomorrow and one of the final messages came from Fed Governor Christopher Waller who said that a 75 basis point hike rather than 100 bps was his base case.

He added a caveat that if today's retail sales report and housing data next week was strong, he could reconsider.

"If that data come in materially stronger than expected, it would make me lean towards a larger hike at the July meeting," he said.

We might soon be grappling with the question of what is materially stronger?

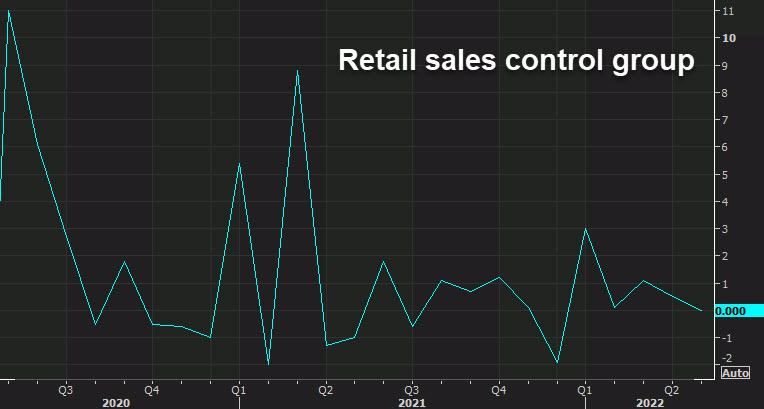

There are two main numbers in the retail sales report: the headline and the control group, which excludes autos, gas and building materials. It's viewed as a better read-through on the health of the consumer.

The headline is expected up 0.8% after a 0.3% decline last month. Economist estimates range from -0.1% to +2.2%.

The control group is forecast at +0.3% after a flat reading in May. Estimates range from -0.6% to +0.7%.

For me, the control group is the one to watch but what if we get a strong headline and weak control group? That will leave the market in a tough spot.

Also keep in mind that retail sales aren't adjusted for inflation, so that adds a hiccup and an upward bias.

Later today we also get the prelim July UMich consumer sentiment survey. Powell cited the inflation expectations metric last month as a contributor to the shift to 75 bps. For more, see the economic calendar.