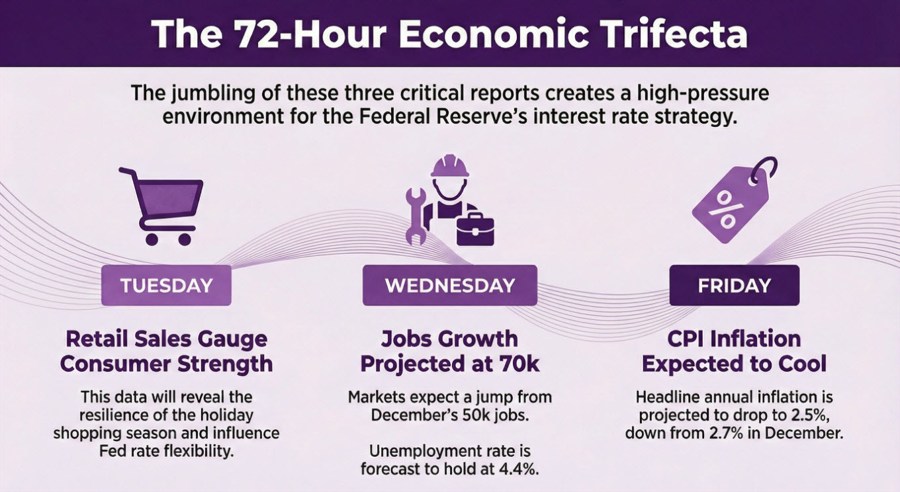

The stakes don't get any higher than this, at least in terms of US economic data releases. In the days ahead, we will be getting the US retail sales, labour market report, and the consumer price inflation report; all within a span of 72 hours.

Typically, you'd see all three reports get spread out across two or three weeks even. However, the short US government shutdown at the turn of the month has kicked the retail sales and jobs data to this week. And that makes it a trifecta of key economic releases that will come from the US in the days ahead.

Amid the more volatile and turbulent market environment, the jumbling up of economic data here will just add to another volatility cluster for markets to deal with.

Things will kick off on Tuesday with the US retail sales data first, which will provide us with some indication of the holiday shopping season. If anything, we can expect the US consumer to continue to stay resilient as it has been last year. This is one spot that hasn't been worrying the Fed all too much, allowing them to keep flexibility in holding interest rates.

Then on Wednesday, we'll get the first key one in the rescheduled US labour market report. The non-farm payrolls headline is expected to see a bump in jobs to 70k, up from 50k in December. Meanwhile, the unemployment rate is expected to hold unchanged at 4.4% in January.

The latest US government shutdown is not one to disrupt the data here, so don't expect any excuses to deny data plausibility here. With the Fed looking for signs of softening labour market conditions and inflation developments as key reasons to cut interest rates further, this will be one of two key areas to pay attention to.

If anything, do also keep an eye on the average hourly earnings as any signs of wage push inflation will also be a consideration for the Fed.

Before we get to the next big data release, there is the weekly initial jobless claims on Thursday. So, that will add to the mix of labour market numbers as well on the week.

And lastly on Friday, there will be the US consumer price inflation (CPI) report. The estimates point to a slight cooling in price pressures with headline annual inflation expected at 2.5%, down from 2.7% in December. Meanwhile, core annual inflation is also expected at 2.5% in January. That will be a marginal decline from the 2.6% estimate in December.

The month-on-month figures will also be ones to watch with both headline and core estimated to show a 0.3% increase. If we do see some hotter numbers here and perhaps stickier annual estimates, that will likely put to be any lingering hopes of a rate cut in 1H 2026.

As things stand, traders are still pricing in ~54 bps of rate cuts by the Fed for this year. The next full 25 bps rate cut is priced in for July but odds of a move in June are at ~92% currently.