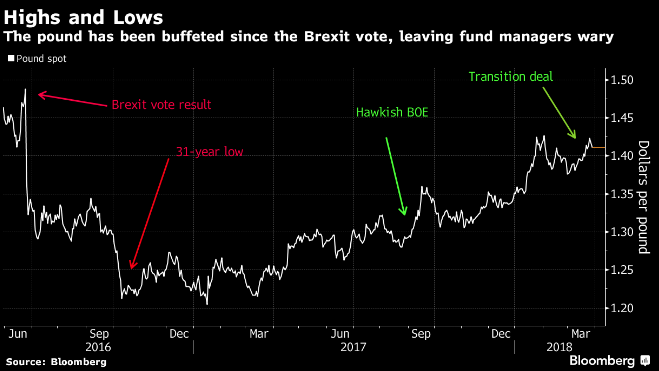

It takes two to make a market, as fund managers are at odds over sterling sentiment

Bloomberg interviewed a couple of fund managers on the matter, and here's what they have to say:

Didier Borowski, head of macroeconomic research at Amundi SA

- The transition deal has not removed political uncertainty from the UK

- We are still in the middle of nowhere and are very much unclear concerning the final deal that will be negotiated

- So we are still very, very cautious concerning our exposure to the currency (they are short sterling btw) and British equity markets

Mike Ridell, portfolio manager at Allianz Global Investors GmbH

- Even as the 20 percent rebound since then reflects improved sentiment, the market may now be overlooking the fact that uncertainties remain

- Markets have gone from being over-concerned about the fallout from Brexit, to flipping the other way

- A deterioration in UK economic data could drive 10-year gilt yields below 1.30 percent in the next 12 months from 1.44 percent currently

- If BOE pauses with rate hike after May, sterling could fall 5% on a trade-weighted basis

Andrew Balls, CIO of global fixed income at Pacific Investment Management Co

- Risk of Brexit negotiations collapsing is now incrementally lower

- Has a long position in sterling versus the euro

Luke Hickmore, senior investment manager at Aberdeen Standard Investments

- Upbeat on sterling's short-term prospects after transition deal

- The eventual outcome is not a straightforward thing to get right in its entirety, which means you have to look to short-term negotiations instead

- Forecasts that EUR/GBP could fall to 0.76 by year-end from about 0.88 currently

Just some food for thought. What are your opinions on this?