The earlier sell off has been largely reversed

Whatever wobbled yen pairs seems to have faded. Our old friend, and ForexLive reader Monsi knows his onions and notes that Japanese sellers have been offloading the bonds of Europe, UK and US, while on the other side European's have been taking up Japanese stocks and bonds.

Whatever was happening, we're undoing some of those moves and the PPI is a big part of that, as higher producer prices just add more fire to the inflation picture in the US, and therefore increase hike prospects further.

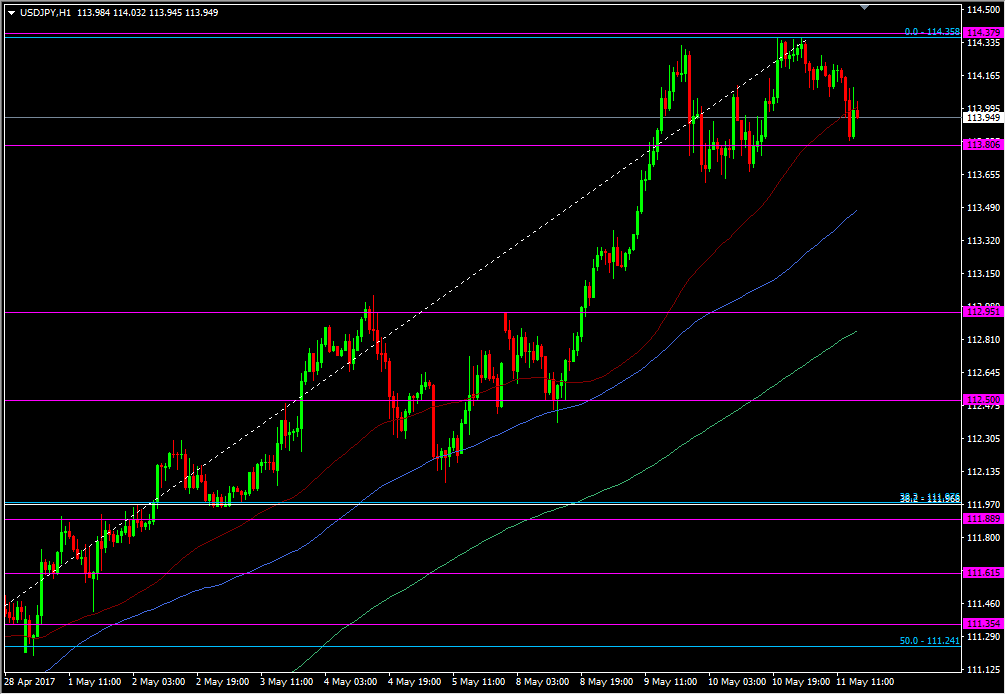

Those of you with good memories might remember the 113.80 level as one of those ones that can catch a top or bottom now and again.

USDJPY H1 chart

114.10 was resistance after the first test of 114.00 earlier and it's helping to keep a lid on this bounce. With the price action being a tad tight again today, the minor intraday levels are going to be the main focus of support and resistance. Yesterday's lows around 113.60 will be a consideration if 113.80 goes, while we should expect to find traffic through 114.10, 20/25 & 35/40.

USDJPY 15m chart

And on those hike expectations, They're still sitting at 100% for June.