Chicago Fed president Evans is speaking at 3.15pm (GMT) and we expect little volatility on his conference, the main focus with be FOMC member Stein speaking at the same time. Traders will be looking for hints as to how much weather has effected US data and whether or not tapering will be halted on the back of this. With the dollar getting a boost since the US GDP release and other positive data expect any hawkish rhetoric to give the dollar another leg higher.

We are also at month end and its a Friday so I cant see us taking out sessions lows for the dollar.

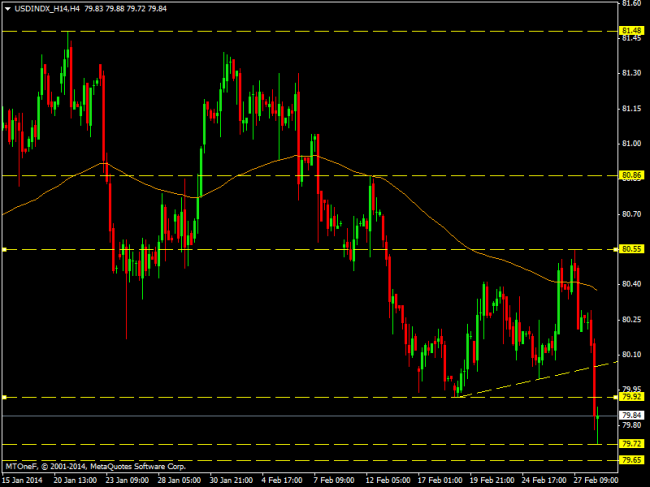

From a technical stand point we have bounced off the 11th of December 2013 lows on the dollar index with the 18th of December lows just below at 79.65. For dollar bulls this could be the base they are waiting for, for the bears a temporary rest bite before we break lower.

DXY 4 hour chart