UBS on G10 currencies with focus on EUR/USD, GBP and the JPY (bolding mine)

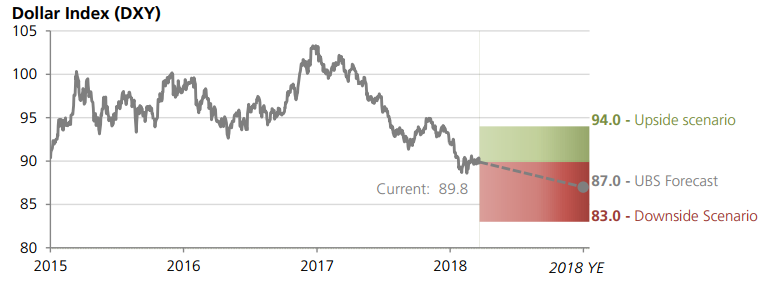

We see little scope for dollar strength

- Although dollar spikes are possible (e.g. against Canada or Japan), the broad backdrop remains bearish for the USD

- Expensive valuation, a hiking cycle that is broadly priced, and easy global financial conditions all suggest further broad dollar weakness

We continue to see upside in EUR/USD

- has remained resilient despite a less positive outcome in Italian elections ... and a flattening of PMI momentum

G10 forecast revisions: GBP and JPY higher

We lower our EUR/GBP forecast in light of the draft withdrawal agreement, which reduces "cliff-edge" Brexit risks and creates near-term upside for sterling (up to c.0.85 in EUR/GBP)

- As a result, sterling's return to fair value is likely to be slower and we now forecast 0.89 by year-end (previously 0.95)

Secondly, we lower our end-18 USD/JPY forecast

- to 108 from 117 in the face of the challenges facing the BoJ's attempt to deliver small changes in YCC without changing the overall policy signal

Finally, we revise our year-end EUR/SEK forecast to 9.5 from 9.2 to account for a likely delay in the first repo rate hike