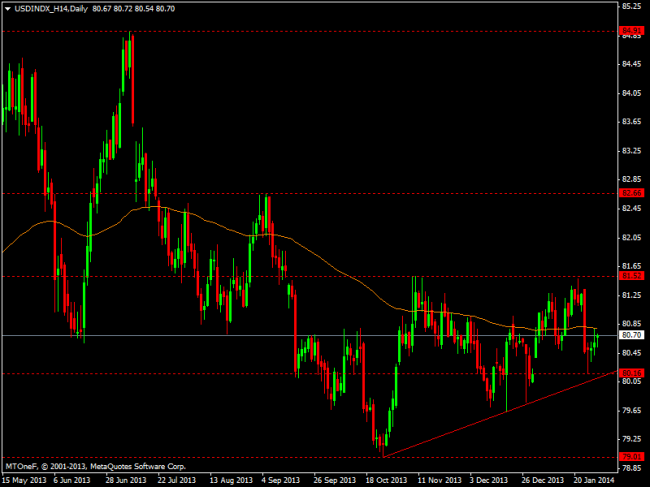

With the market awaiting the FOMC this evening the DXY is starting to set up nicely for a clear break. Should the FED taper expect a test of at least the 81.52 resistance, a break through there and we eye the 82.66, this is the November 2013 high and the 61.8% fib from 84.91 to 79. No taper and we watch the upward sloping red support line.

Despite the $ strength against commodity currencies and EM currencies it has struggled to do as well against the EUR and GBP, with this in mind should the FED taper I like short AUDUSD and long USDCAD. No taper get long EURUSD and long GBPUSD, with USDJPY likely to be a good trade in both scenarios.