Early indications are the China - US tariff war agreement is being viewed sceptically.

Forex rates have shown approval, with yen crosses all higher in early trade, check here for example. but more considered responses are not convinced.

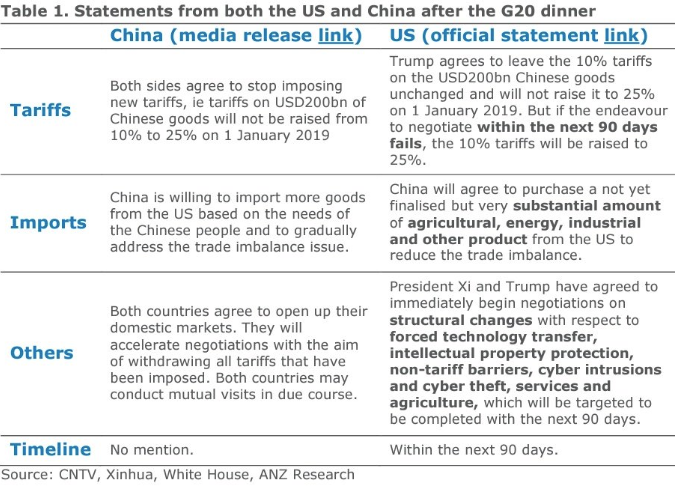

ANZ compare the two statements (from China vs. from the US), they do like quite different:

Westpac make the point that sorting through long-standing issues such as technology transfer and the protection of intellectual property will not be resolved in 90 days, doing so would be 'very surprising'. The bank add that China will want to avoid appearing to 'cave in' at the conclusion of the 3 month period as it coincides with the country's annual national assembly.

So, scepticism abounds, but that hasn't stopped a 'risk on' mood here in Asia in the early going. Here is AUD/JPY, for example:

US equity (overnight) index trade will open soon, that whouls be higher also.

I suspect 'gap fill' tactics might be best for today, we'll soon find out!