New Zealand Retail Sales data (excl inflation) for Q2

- expected +0.3% q/q, prior +0.1%

ASB on what they expect:

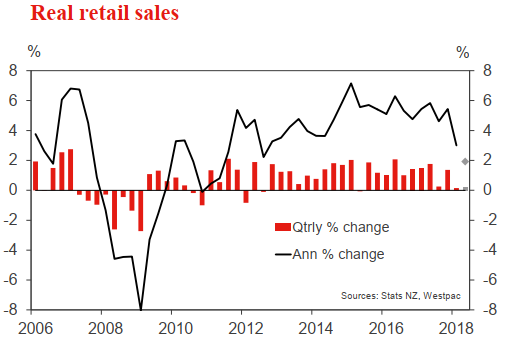

- We expect another sub-par quarter for retail sector volumes as easing consumer sentiment and slowing house price inflation see consumers display restraint. Nominal card spending declined in Q2 (retail -0.5% qoq, core -0.3% qoq). And while this does not line up with retail sales values (correlation coefficient of less than 0.5% for quarterly movements), we expect the retail survey to confirm a slowing in annual volume growth for both total and core retail volumes.

- Also weighing on retail volumes will be the likely Q2 increase in retail prices (Q2 CPI rose 0.4% qoq). Liquor and electrical and electronic goods retailing should likely fall following Q1 strength. Partly offsetting this will be a rebound in apparel retail, and while tourist numbers were down in Q2, guest nights were up, which should support accommodation and food & beverage services.

- We expect quarterly consumer spending growth to modestly strengthen towards the end of the year given increased government support, increasing wages and higher producer incomes. Headwinds posed by a still-becalmed housing market and high fuel prices should ensure that annual retail volume growth is moderate.

Via Westpac:

- After adjusting for price changes, retail spending was essentially flat over the March quarter. Much of the weakness in spending was concentrated on fuel and vehicle spending (dampened respectively by rising petrol prices and delays with vehicle importation). Spending in core categories rose by 0.6% over the quarter.

- We expect that overall retail spending will rise by 0.2% in the June quarter, including a 0.3% rise in the core categories. This modest pace of growth is consistent with the cooling in the housing market that is weighing on spending appetites.

- The key risk around our forecasts are recent delays with vehicle imports. It is not clear how much of this was captured in the March quarter, and we could see a larger than expected bounce back in this category.