According to Viraj Patel, a research analyst at the firm

Patel says that the downwards trend in USD/JPY is likely to persist, supported by protectionist measures from the Trump administration.

"With global trade wars in focus - and the yen the antithesis of US protectionist policies - we expect the downward bias for USD/JPY to remain firmly in place over the coming months", Patel argues.

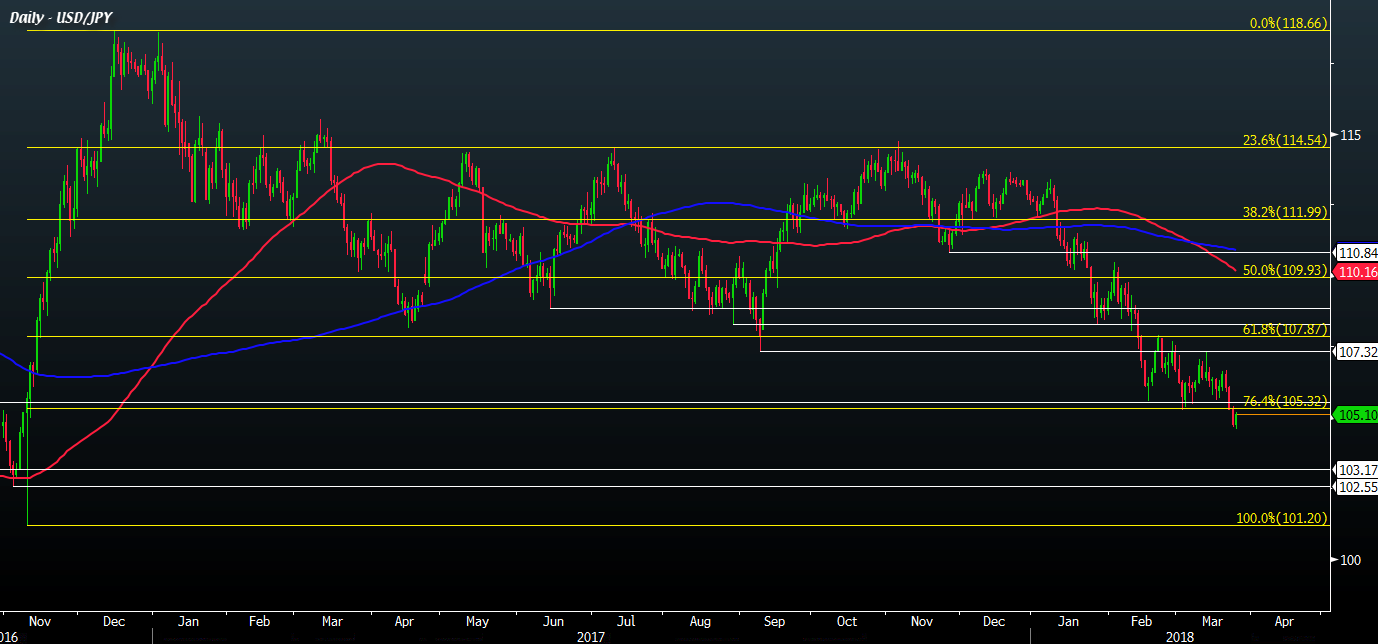

However, he says that the pair will be anchored around the 105 level this week in the absence of an escalation in the trade war narrative or any further leg lower in global equities. Though he says that the scope for a move to the upside will be limited.

"Japanese fiscal year-end and a negative USD bias from White House policy uncertainty should limit the scope for any significant upside in the pair (with the sell-on-rallies theme persisting)", Patel says.

Well, if equities are to come back in stunning fashion this week it's hard to see USD/JPY or yen pairs for the matter anchored at current levels. The bigger picture still points to a move to the downside, but it's hard to argue that a genuine rebound in risk sentiment will not see the pair bounce back towards the previous range of 105.32 to 107.32.