Japan finance minister Aso talked about rate differentials between US and Japan as a reason for USD/JPY to strengthen

Let's face it. Japanese officials are running out of ways to verbally intervene in the market. When you can't talk down your currency, why not try to drag the opposing one higher instead.

That's the approach that Aso is taking here. And here's why it is something that won't work, or at least hasn't been working for the last few months.

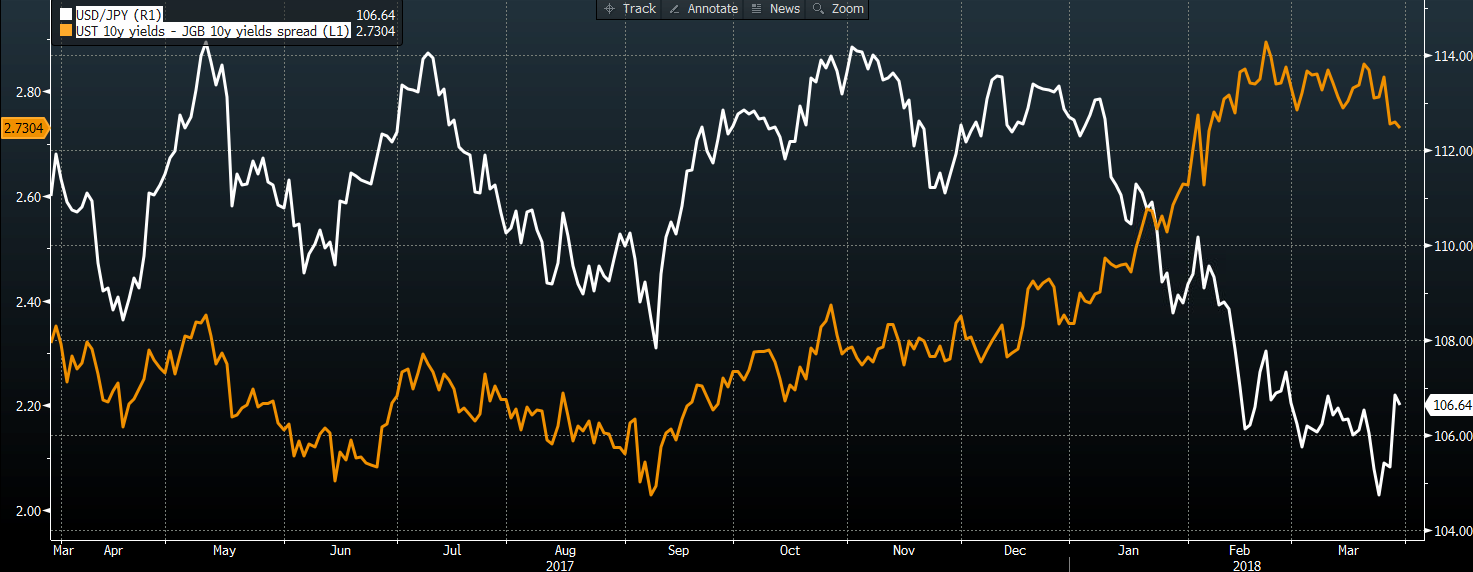

Aso said that if rate differentials between US and Japanese yields touch 3%, then the dollar would strengthen against the yen. Here's what the chart shows:

Does it look familiar? That's because Japanese 10-year bond yields are sitting near 0%, so this is basically a chart showing the correlation between US 10-year Treasury yields and USD/JPY. It's one that has come up in a few posts over the months here, and it's one I even talked about yesterday here.

So, while Aso's argument is that USD/JPY should rise if US-Japan yield differentials move to 3%. The same can be said back in January but look where we are now. Considering the market hasn't been listening for the last three months, I'm surprised he believes there will be a sudden shift based on a few words.