Forex and cryptocurrency news from the European trading session - 6 April 2018

News:

- A recap of the previews of the US jobs report later

- More from Coeure: High degree of ECB policy accommodation still needed

- China calls on EU to stand together to uphold WTO rules

- China says that US-China trade conflict is caused by the US

- USD/JPY completes round-trip after fall from Trump announcement

- China's door for trade negotiation still open - Xinhua commentary

- Russia's Novak says OPEC and non-OPEC nations may revise oil output quotas in June

- Japan's FSA imposes penalties on 3 cryptocurrency exchanges

- IFO to change its methodology for business climate index calculations

- FX option expiries for the 14.00 GMT cut - 6 April 2018

- Moody's say New Zealand credit profile reflects high economic resilience

- Danske says that EUR/GBP is to consolidate as the BOE hikes in May

- Russia says they will soon be discussing measures to protect companies from US trade tariffs

- Bank of Italy's Panetta says ECB monetary policy should remain expansionary for a long time

- South Korea notifies WTO that it may raise tariffs on some US imports

- China to hold media briefing at 1200 GMT on China-US trade relations

- Early signs that investors aren't as confident in the Eurozone anymore

- AUD/NZD fails at another crack lower, then bounces higher on the day

- ECB's Coeure says winding back globalisation is the wrong solution

- European equity markets open lower 6 April

- Switzerland March foreign currency reserves CHF 737.8 bn vs CHF 735.8 bn expected

- Spain February industrial production m/m +1.5% vs +1.6% expected

- Morgan Stanley stays bullish on the USD amid trade tensions

- The kiwi's day in the sun appears short-lived

- Germany February industrial production m/m -1.6% vs +0.2% expected

- Trading ideas for the European session 6 April

- SocGen says USD/JPY is toppish around 107.50

- More from China: Will firmly fight back against US protectionism

- The SNB sure knows how to make them banknotes

- Cable slips below 1.4000, eyes retest of nearby support level

- SMBC says BOJ may need to alter its policy if Trump complains about the yen

- ForexLive Asia FX news: Trade war fears reignite, not for too long

Data:

- France February trade balance -€5.19 bn vs -€5.31 bn expected

- Eurozone March retail PMI 50.1 vs 52.3 prior

- Germany March construction PMI 47.0 vs 52.7 prior

- Japan February preliminary leading indicator index 105.8 vs 105.5 expected

Trade wars still dominating the headlines but it's been a far steadier session with US NFPs casting a shadow.

USDJPY and USDCHF still underpinned at 107.00 and 0.9600 but finding sellers at 107.50 and 0.9660 still in a mixed USD session overall.

GBPUSD trawled around 1.3985 for a while but then some GBPJPY demand and EURGBP supply helped push the pair up to 1.4026 before failing once again into the 1.4030 pivot.

AUDUSD still remains in a 0.7650-00 range while USDCAD has been underpinned helped by CADJPY supply but tightly bound. Large option expiry interest at 1.2875 and 1.2900 in play through NFPs

Oil found some support on bullish tones from Russia but gold and equities finding it tough going again.

Bitcoin has had another soggy session to post $6526 from $6800

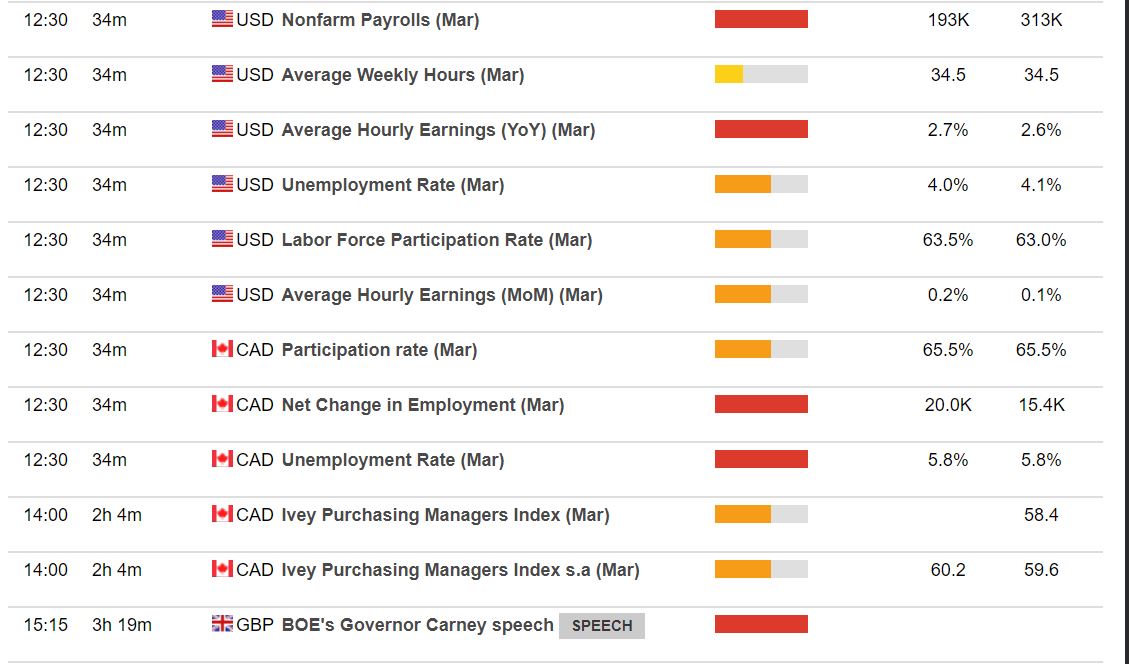

Data/event risk coming up;