Forex and cryptocurrency news from the European trading session - 5 April 2018

News:

- Former Fed chair Yellen says three to four rate hikes are likely this year

- EU's Barnier says Brexit process must be transparent

- North Korea's Kim told China of intent to rejoin six-party talks - report

- RBI keeps repo rate unchanged at 6.0%, reverse repo rate at 5.75%

- EUR/USD bounces off long-term trendline support

- Eurozone's slower start to the year continues on

- FX option expiries for the 14.00 GMT cut - 5 April 2018

- Treasuries market shouldn't worry too much about China for the moment

- Merkel heading across the pond to talk with Trump

- Dollar extends gains as European trading gets going

- European equity markets open firmer 5 April

- Qatar energy minister says OPEC and non-OPEC cooperation should stay even after cuts end

- Trading ideas for the European session 5 April

- Nomura says that ADP report poses upside risks for tomorrow's US jobs report

- Nikkei 225 closes higher by 1.53% at 21,645.42

- Oil holds steady after hugging trend-line support

- EUR/USD still calm as it trades near key long-term support level

- US dollar quietly leads the major bloc on the day

- BOJ report shows household inflation expectations remain unchanged from 3 months ago

- Here's the reason why Japan is being awfully quiet about US tariffs

- Asian equities quick to forget about the pain yesterday

- GBP/JPY runs into a stubborn resistance level again

- ForexLive Asia FX news: USD/JPY edges higher

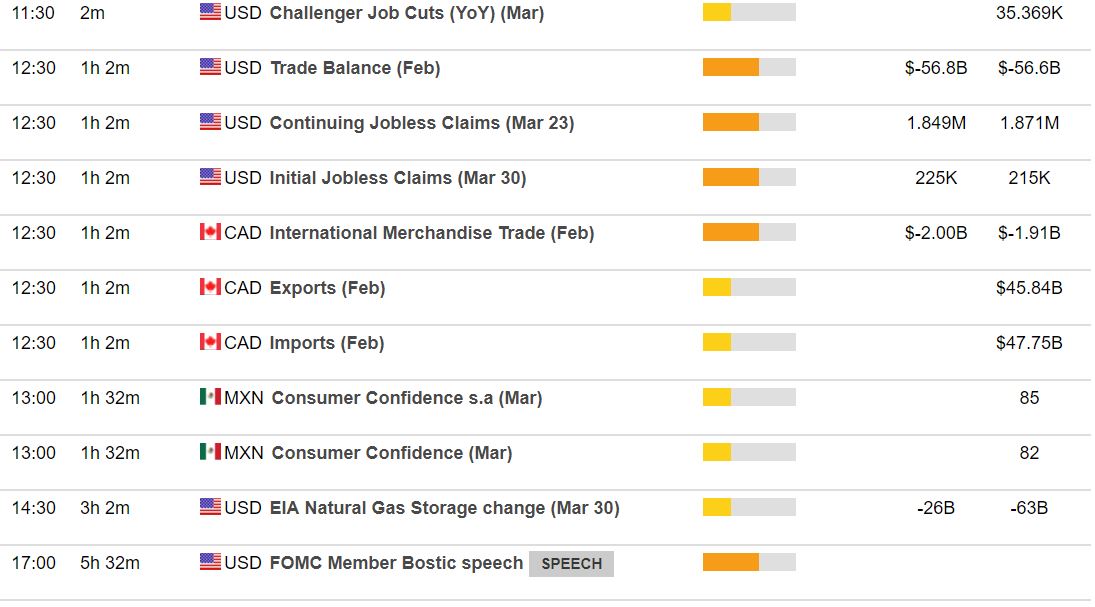

Data:

- UK Markit/CIPS March services PMI 51.7 vs 54.0 exp

- Eurozone Feb PPI mm 0.1% vs 0.0% exp

- Eurozone February retail sales m/m +0.1% vs +0.5% expected

- Eurozone Markit March services PMI final 54.9 vs 55.00 exp

- Germany March final services PMI 53.9 vs 54.2 prelim

- Germany February factory orders m/m +0.3% vs +1.5% expected

- France Markit March services PMI final 56.9 vs 56.8 exp

- Italy March services PMI 52.6 vs 53.9 expected

- Spain March services PMI 56.2 vs 56.0 expected

- Switzerland March CPI m/m +0.4% vs +0.2% expected

After yesterday's trade war-led fun and games it's been a far more sober affair today in the FX markets with risk-on sentiment generally prevailing as equities recover some poise.

USDJPY made early gains to 107.15 from 106.95 but option interest has helped cap the advance and we're sitting round 107.00 again as I type.

General USD demand has seen EURUSD test 1.2250 again before trawling around 1.2270 and GBPUSD fall to 1.4030 after some soggy UK services PMI data after once again failing at 1.4100 in Asia.

USDCHF remains underpinned helped by SNB (threat of or actual) but has failed at 0.9630 to test support/deman around 0.9600

AUDUSD also failed at 0.7725 again and we've seen a test of the other end of the range at 0.7680 while USDCAD has been tightly bound but still under a little pressure after the positive NAFTA deal comments.

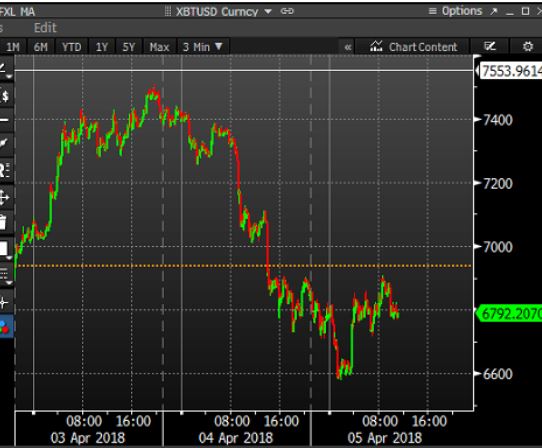

Bitcoin has found support at $6600 after yesterday's fall from $7400 but so far failing to get back above $6900.

Equities opened firmer and made further advances while oil has retreated slowly with WTI posting $63.20 from $63.60. Oil has made small gains to $1330 from $1326 after the retreat from $1347 since yesterday.

US data and Fed heads coming up: