Forex and cryptocurrency news from the European trading session - 3 April 2018

News:

- Tit-for-tat, what tariffs are coming next between the US and China?

- China will fight back any new US tariffs at equal strength, value, and scale - state media

- China hopes to resolve differences on trade via talks

- Japan's Monex confirms it is considering to buy Coincheck

- Liikanen to succeed Draghi as ECB president next year?

- PBOC says central banks says may resort to negative interest rates more often in the future

- Citi says that Australia fares better than most in a global trade war

- RBA decision doesn't do anything for the aussie dollar

- The added text in the RBA's April statement doesn't offer much

- Full text of the April RBA cash rate decision

- RBA leaves cash rate unchanged at 1.50%

- USDJPY steady again after early wobble

- NZDUSD rally contained by large option interest today

- Russia's Novak says it's too early to talk about extending oil pact with OPEC

- FX option expiries for the 14.00 GMT cut - 3 April 2018

- Nomura expects the aussie to ease further following the RBA decision

- Alexis Tsipras says Greece will hold elections in autumn of 2019

- Rabobank says main focus this week will be on US labour market report

- UAE energy minister says production cuts deal is benefiting global economy

- FX market sees no reason to panic just yet

- SNB total sight deposits w.e. 30 March CHF 575.4 bn vs CHF 576.0 bn

- European equities open lower to start the day

- Trading ideas for the European session 3 April

- More from Kuroda: Debating exit now would cause confusion

- BOJ's Kuroda says that doesn't see a big problem from ETF purchases

- Nikkei 225 closes lower by 0.45% at 21,292.29

- EU warns UK banks not to rely on Brexit transition deal - report

- SMBC says that the dollar isn't the only currency investors have to buy

- ForexLive Asia FX news: AUD edges up ahead of RBA

Data:

- UK Markit/CIPS March mftg PMI 55.1 vs 54.7 exp

- Eurozone Markit March mftg PMI final 56.6 vs 56.6 exp

- Germany March final manufacturing PMI 58.2 vs 58.4 prelim

- France Markit March mftg PMI final 53.7 vs 53.6 exp

- France YTD February budget balance vs -€28.5 bn vs -€10.8 bn prior

- Australia Mar commodity prices (SDR terms) y/y -2.1% vs -1.0% prior

- Italy March manufacturing PMI 55.1 vs 55.4 expected

- Germany February retail sales m/m -0.7% vs +0.7% expected

- Switzerland March manufacturing PMI 60.3 vs 64.3 expected

- Spain Markit March mftg PMI 54.8 vs 54.7 exp

- Switzerland February retail sales y/y -0.2% vs -1.4% prior

Early USD sellers prevailed but in the last hour or so it's been a case of about-turn with yen demand also returning.

USDJPY began with a dip to test decent demand around 105.75-80 from 106.05 on Kuroda comments but then bounced in equally rapid time and then went on to post 106.28 before running into fresh sell interest and yen demand as equities wobbled.

That yen and USD demand has also helped cap core pairs and we've seen GBPUSD down to 1.4025 from 1.4089, EURUSD 1.2285 from 1.2335, AUDUSD 0.7680 from 0.7706, NZDUSD 0.7243 from 0.7263

USDCHF has held above 0.9530 to post 0.9571 before running into sellers of its own but EURCHF has held on to its own gains

Equities have traded lower from the off while oil has seen a gentle retreat all session. Oil fell to $1336 from $1342 but been back to $1339.

Bitcoin has had a good session to rally from $7000 to $7400.

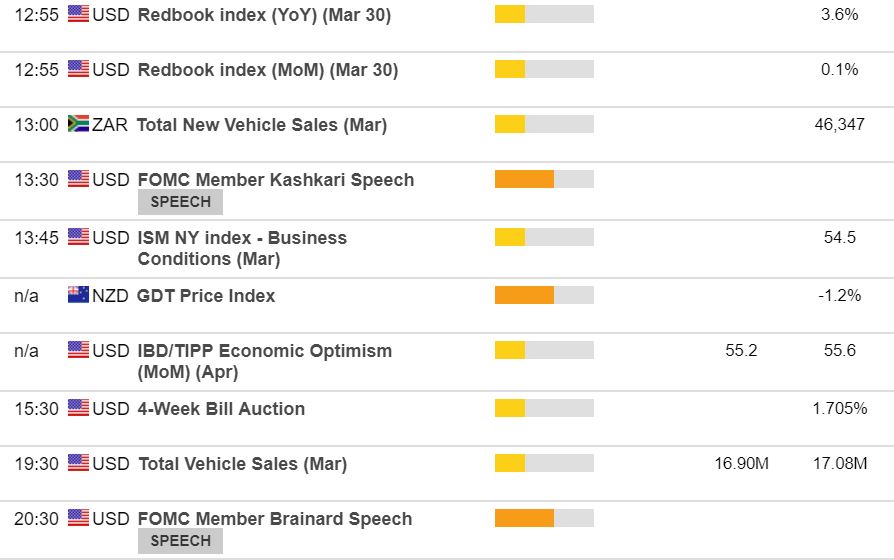

US data and Fed head Brainard to come: