Forex and cryptocurrency news from the European trading session - 29 March 2018

News:

- Fed's Harker lifts his forecast to 3 rate hikes this year - report

- PBOC says that they will launch crackdown on cryptocurrencies this year

- UK's Fox says that it would be 'quite absurd' if US tariffs apply to the UK

- Here's why Aso's attempt to jawbone the yen lower today isn't succeeding

- Japan's Aso says that USD would rise if US-Japan rate differential reach 3%

- Aso says that Japan's stance is to avoid bilateral trade negotiations with the US

- Latest Reuters poll sees average oil prices rising even further this year

- FX option expiries for the 14.00 GMT cut - 29 March 2018

- How much do mega-deals factor into the FX market?

- Kremlin says Russian president Putin is to meet with energy minister Novak later today

- Commerzbank says ECB could be in for an inflation summer surprise

- EUR/USD tries for a run below 1.2300 again

- UK's Fox does not think transition period will extend beyond the end of 2020

- European equity markets open a little firmer 29 March

- Switzerland KOF March leading indicator 106.00 vs 107.2 exp

- Saxony March CPI m/m +0.4% vs +0.4% prior

- South Korea expects denuclearisation to be key agenda during inter-Korea summit

- Don't be fooled by the performance of Asian equities today

- UK March Nationwide house price index m/m -0.2% vs +0.2% expected

- Canada's Morneau says that NAFTA negotiations are 'going well'

- North and South Korea to hold inter-Korean summit on 27 April - report

- Trading ideas for the European session 29 March

- Westpac says that Euro-area growth is to slow down further

- Fundstrat's Tom Lee says HODL is the way to go for Bitcoin

- What are fund managers saying about sterling and Brexit?

- ForexLive Asia FX news: AUD and NZD extend losses a little

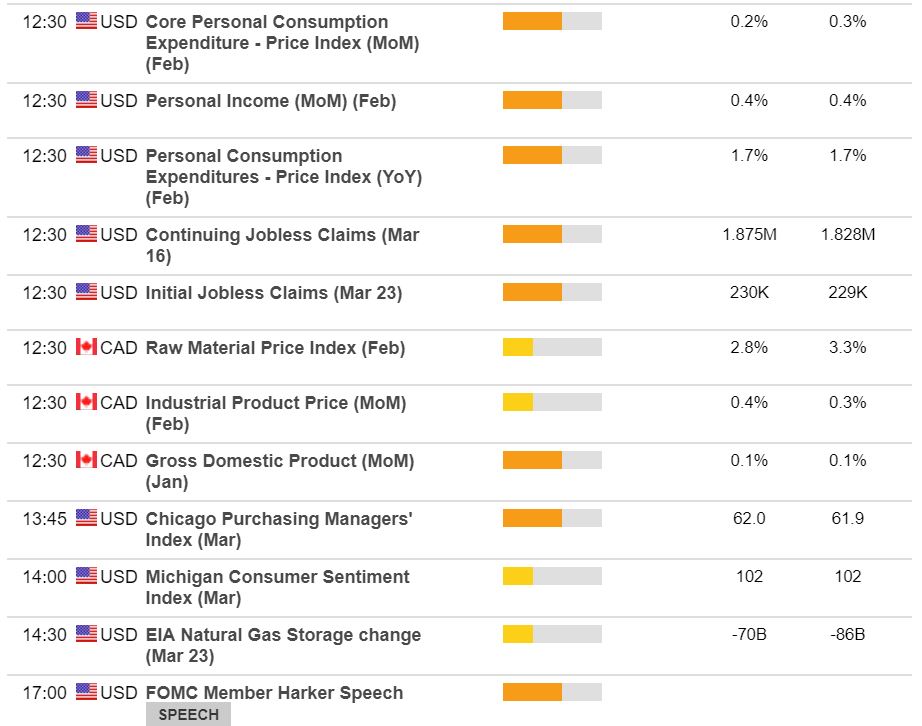

Data:

- UK Q4 GDP final qq 0.4% vs 0.4% expected

- Germany March unemployment change -19k vs -15k expected

- UK February mortgage approvals 63.9k vs 66.0k expected

- North Rhine Westphalia March CPI m/m +0.4% vs +0.5% prior

- Baden-Wuerttemberg March CPI m/m +0.4% vs +0.5% prior

- Italy February PPI mm 0.3% vs 0.8% prev

- Brandenburg March CPI m/m +0.4% vs +0.3% prior

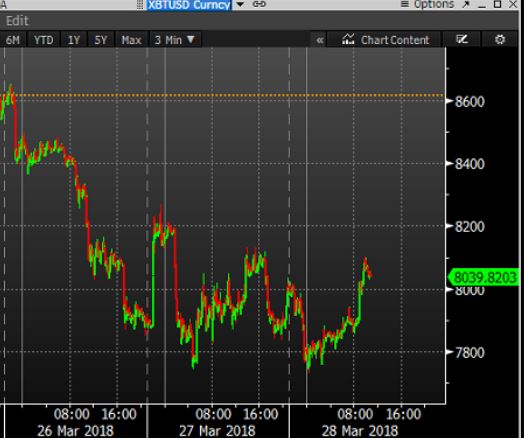

A steady session as month-end draws near and we've seen USD demand prevail once again. Bitcoin is tumbling again

Mostly USD dominated again today with USDJPY holding 106.30 after retreat from 107.00 in late NY/Asia. USDCHF up to 0.9584 after holding 0.9550.

GBPUSD has been down to 1.4035 from 1.4080 on the added push given by EURGBP month-end demand again that saw EURGBP up to 0.8770 from 0.8750

EURUSD tested good support/demand around 1.2300 from 1.2320 but has since returned while USDCHF capped at 0.9584 to retreat to 0.9560

USDCAD has a battle going on above 1.2900 with large option expiry interest at 1.2950 and has fallen from 1.2930 to 1.2900 as I type.

AUDUSD has large option interest at 0.7600 and that, along with some USD retreat has helped rally from 0.7650 to 0.7680.

Bitcoin has had a really soggy morning to post $7450 from $7900.

US/Canadian data to come: