Forex and cryptocurrency news from the European morning trading 26 Mar 2018

News:

- China reportedly stepping up efforts in trade negotiations with the US - FT

- Chinese premier Li says there is no winner in trade war between US and China

- China says that US tariffs are putting WTO 'under siege'

- China to seriously assess impact from US and Europe measures towards them

- South Korea's trade minister says US was most interested in cars in Korus deal

- South Korea gets a pass on steel tariffs after agreeing trade deal with the US

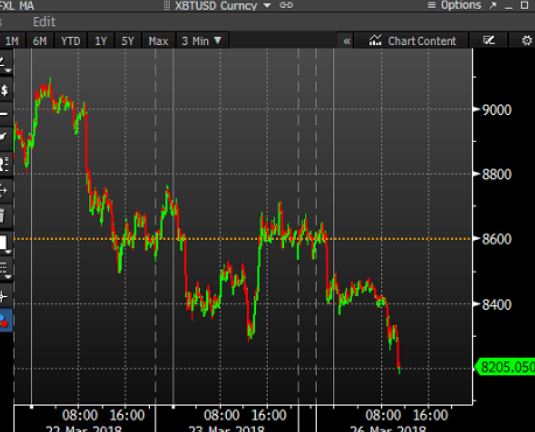

- Bitcoin in retreat again but support nearby

- FX option expiries for the 14.00 GMT cut - 26 March 2018

- IMF's Lagarde says it would be best for Euro-area to prepare now for the next crisis

- Riksbank's Skingsley says rate hikes could happen in H2 2018

- ECB's Weidmann says expectations for mid-2019 rate hike "not completely unrealistic"

- Cable climbs to highest level in almost two months

- Swiss government says IMF advises continued monitoring of mortgage and real estate market

- IMF says SNB intervention strategy has proved its worth

- EU said to begin probe into possible 'safeguard' protection for steel

- Top research institutes expect Eurozone economy to post 0.6% growth in Q1, Q2 2018

- Further talks on Irish border issue today

- PBOC confirms Guo Shuqing as Communist Party secretary of the central bank

- IMF's Lagarde says rise of populism and calls of protectionism threatens global growth

- SNB total sight deposits w.e. 23 March CHF 576.0 bn vs CHF 575.9 bn prior

- ING says the 'sell on rallies' theme in USD/JPY is to persist

- Trading ideas for the European session 26 March

- European equities start the week with a positive footing

- S&P 500 futures continues to surge higher

- France's Le Maire says debt reduction is a priority objective for the government

- Kuroda says BOJ implementing appropriate policy

- Nikkei 225 closes higher by 0.72% at 20,766.10

- EUR/USD takes a peek to the upside

- NAB sees AUD downside limited by USD weakness

- A heads up on Fed speakers due later in the day

- A general reminder that UK clocks have been move forward by one hour

- Australia's prime minister Turnbull set for 'Newspoll test'

- NZD/USD heads towards 0.7300 again after key support levels held last week

- Oil falls after failing to break above this year's high

- ForexLive Asia FX news: Plenty of early in the week forex action

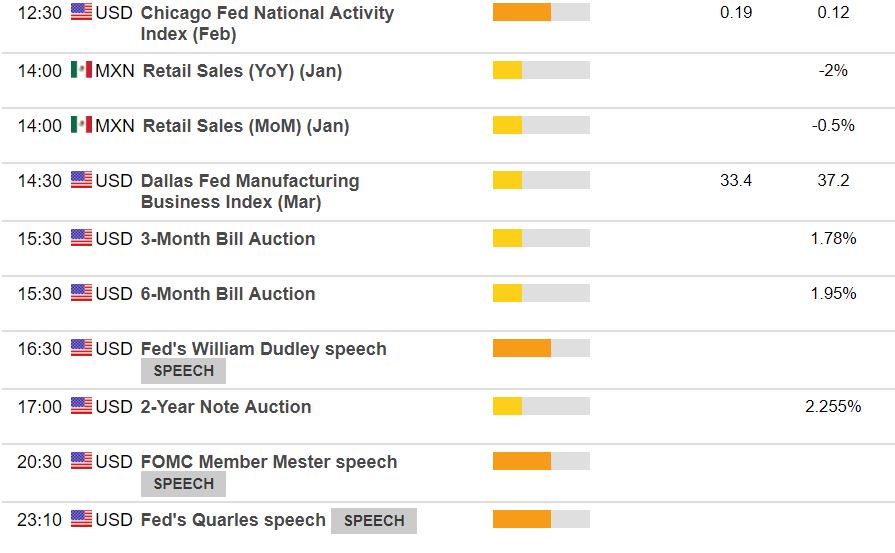

Data:

- UK Finance February mortgage approvals 38.12k vs 40.12k prior

- France Q4 final GDP q/q +0.7% vs +0.6% prelim

- China February crude oil imports +1.5% y/y

- Switzerland Q4 current account comes in at CHF 20 billion - SNB

Stronger equity market showings and hope that US/China can cut some kind of trade deal have helped produce some risk-on sentiment to start the week.

USDJPY has been underpinned above 104.80 albeit with sellers still into 105.20 but the general yen supply on cross pairs has helped lift core pairs too.

GBPUSD has continued to feel some love after last week's Brexit transition deal positive response and now posted 2-month highs of 1.4225 with GBPJPY making solid gains while EURUSD has found EURJPY support to post 1.2417. EURGBP has been contained between 0.8717-35.

USDCHF has retreated a little on some USD supply but from 0.9475 has held 0.9450. USDCAD has found itself on the rise from 1.2840 to post 1.2883 with oil posting a few risk-on losses.

AUDJPY demand and large-ish option interest at 81.50 has helped lift AUDUSD to test 0.7750 from 0.7720 while NZDUSD has similarly moved up 0.7292 from 0.7265.

Bitcoin has found itself in retreat again and after failing to breach $8500 finally broke down through support around $8250-300 to post $8195.

European equities have posted solid gains but not racing away with DAX up 0.7% while gold posted early losses to $1344 from $1348 only to bounce back.

Not a lot on the data board but a few US Fed talking heads to watch out for:

Times GMT: