Forex and Bitcoin news for Asia trading Wednesday 25 July 2018

- Australian inflation for Q2: Headline CPI 0.4% q/q (expected 0.5%)

- PBOC sets USD/ CNY central rate at 6.8040 (vs. yesterday at 6.7891)

- The Bank of Japan left the amount of JGBs purchased unchanged at its operation today

- Trump calls for free trade with the EU (no mention of TPP free trade)

- Securities Journal opinion piece says China to be more flexible on monetary policy

- Trump sent a letter to Mexico, aid wanted NAFTA done quickly

- UK Times on Brexit: Hard border ‘could protect Irish interests’ (Times quote 'sources')

- German foreign minister says Britain needs to move in Brexit negotiations

- New Zealand Trade Balance for June: NZD 113m deficit (vs. expected 200m surplus)

- Goldman Sachs - pain ahead for fixed interest, more concerned on bonds than equities

- Japan press: BOJ unlikely to make changes to monetary policy at least until October

- Trade ideas thread - Wednesday 25 July 2018

- Private oil inventory data shows a larger than expected drawdown of crude oil inventories

The People's Bank of China cracked 6.8 at today's reference rate setting for USD/CNY, sending the onshore yuan mid rate to its lowest since late June of last year. The markets seems like it is becoming accustomed to a lower CNY, a wider currency response to the news was pretty much absent

Apart from our daily fix out of China the market focus was the once-a-quarter inflation data from Australia. Yet again the result came in below the market consensus estimate, this making it seven quarter in a row. The result for the two 'core' measures, though were in line and as the meaty chap once sang, two outta three aint bad.

The Australian dollar had traded slightly higher into the data and after a brief pop above 0.7440 gave back its days gains in the following hour or so and then drifted to a fresh session low. The range for the AUD/USD on the session was 40+ points which, unfortunately, seems to be a decent size for the time zone here at present.

Elsewhere there is not too much change of rates to report. EUR/USD followed a similar pattern to the AUD/USD; up and then down, but it has barely scraped up a 15 point range or so.

USD/JPY too, done little. GBP, CHF, NZD, CAD are all trading currently also just slightly softer against the USD. Note on the NZD - the trade balance data came in at a surprise deficit today. Its impact was blunted by a strong showing from imports suggesting the economy still has strength.

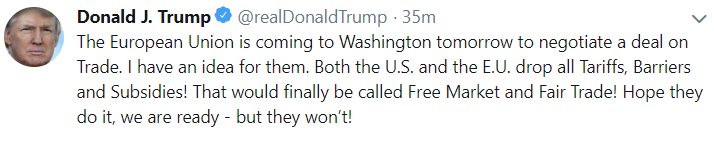

Wednesday US time will bring the US /EU trade talks. President Trump was in taunting mode ahead of the talks:

He didn't mention the TPP free trade agreement that he backed out from though.

Still to come: