Forex and Bitcoin news for Asia trading Tuesday 24 July 2018

- Hedge fund manager says the trade war is only one of four key risks

- The PBOC set yuan at its lowest on more than a year. Trump tweet on the way?

- PBOC sets USD/ CNY central rate at 6.7891 (vs. yesterday at 6.7593)

- Japan Manufacturing PMI data (flash) for July: 51.6 (down from 53 in June)

- The yuan drop is due to USD strength. Nope, wrong.

- Australia weekly consumer sentiment: 118.9 (prior 121.5)

- NZD traders: NZ government might loosen its budgetary rules before next election

- China's new measures to boost growth

- Trade ideas thread - Tuesday 24 July 2018

- ICYMI: Bundesbank bullish on German economy

- ICYMI: JP Morgan's Dimon warns on tariffs reversing US economy gains

The People's Bank of China were back, big time, today, slashing the CNY against the USD again; this time to a (more than) one year low at the daily central rate setting.

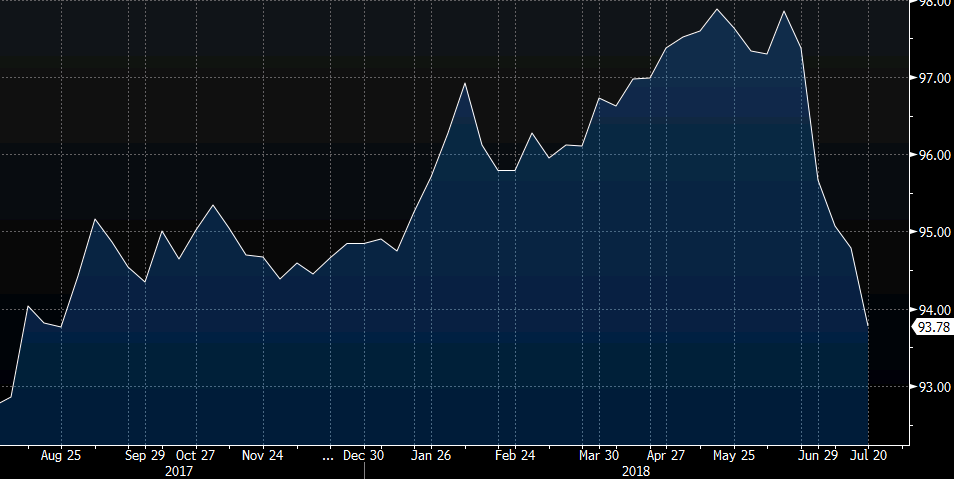

Before I go on, I just wanted to yet again dispel the notion that the yuan devaluation by the PBOC is a purely a USD strength related move. It isn't. The yuan has also been set much lower by the Bank against its basket, i.e. down against a broad range of currencies. Its wiped out 10 months of gains in the past few weeks:

Yen was the other mover today, USD/JPY up to circa 111.50 in the early part of the Tokyo morning and then on the slide to (briefly) under 111.10 just after the yuan 'fix'. The lower yuan saw (brief) flows ot of risk and into the yen but these soon reversed a little. China stocks have gained well today, the Shanghai Composite is up +1.5%.

USD/JPY is now not too far off mid-range around 111.25-odd

Other currencies are barely net changed on the session. EUR, CHF, GBP, AUD, NZD, CAD against the USD are all more or less where they were at the end of US trade.

It is PMI day in Europe. Eyes are on the indicators ahead of the ECB meeting Thursday. Expectations are for little change from the Bank, but keep an eye for any surprises from the PMIs today. A quick scan of EUR/USD chart tells me it looks a wee bit heavy. Curious. Oh yes, ahead of the ECB are US/EU trade talks on Wednesday.

Still to come: