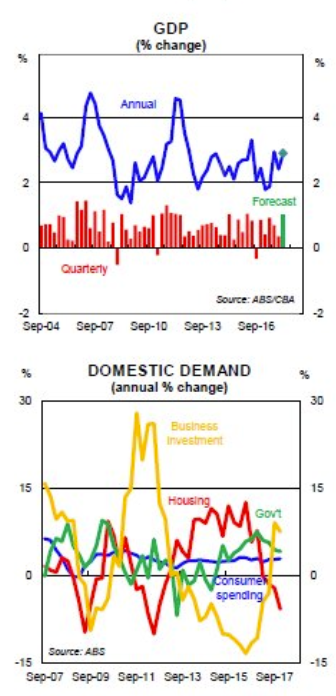

Data due today for Australian Q1 (January - March) GDP growth

- expected 0.9% q/q, prior 0.4%

- expected 2.8% y/y, prior 2.4%

Due at 0130 GMT

I posted yesterday by way of preview:

Expectations for today are up due to the generally better 'partial' data we have had the past days (i.e. components of the GDP figure improving).

Preview via CBA after the 'partials' (in brief, bolding mine):

Based on the economic information to date, we have forecast Q1 GDP at +1.0%

- annual growth ... a little above trend at 2.9%

- This makes sense given the big lift in employment growth over the past year

The components of GDP should show that growth was broad-based:

- modest lift in household consumption after a solid Q4

- a lift in residential construction

- modest increase in business investment comprising a rise in both engineering construction and plant and equipment spending partially offset by a fall in non-residential construction

- lift in public consumption partially offset by a fall in public investment

- 0.3ppt contribution to growth from net exports because the rise in export volumes was bigger than the lift in imports

More:

- lift in the terms-of-trade over the quarter

- Compensation of employees softened over Q1 as the pace of job creation eased. But company profits rose solidly.

- We think the risks to our Q1 call are titled to the downside given the headwinds faced by the consumer

And, a real quickie from Westpac (in brief, bolding mine):

- As to risks around our Q1 GDP forecast, the consumer remains a key uncertainty. We expect consumer spending to increase by around 0.6%, representing a moderation from the 1.0% burst in Q4.

- More generally, we note that the national accounts data is somewhat dated and that some recent developments have been less favourable - eg jobs growth has slowed, the housing market has slowed further with house prices pulling back from their highs, and commodity prices have eased a little. Key headwinds remain, notably, weak wages growth is constraining the consumer and the housing sector is cooling as lending conditions tighten.

More:

Expectations have risen after the various partial data over the past week or two

1.1% q/q … Westpac forecasts … would be the strongest quarter since Q4 2011

- A gain of 1.1% should produce annual growth of 3.0%yr, which would obviously be very welcome in Canberra and at the RBA, where forecasts are for 3+% growth this year and the next. But Australia has managed a grand total of one quarter (Q2 2016) with annual growth at or above 3% since 2012. We expect that it will remain difficult to maintain growth at this pace.

- this is partly a rebound from the dismal 0.4% in Q4 2017; specifically, net exports look to have swung from a -0.5 percentage point subtraction from growth to a 0.3ppt contribution.

- … household consumption, where we concede downside risks if the saving rate doesn't fall further, given that it was not a great quarter for retailers.

---

Note, bothe WPAC and CBA highlight risk is the consumer .... that's because we only get the 'private consumption' partial with the release of the GDP .... so its a key wildcard