The retail sales numbers for August from Australia are the data focus for the country this week.

- Consensus median estimate is for +0.2% m/m

- July was flat at 0.0% m/m

Preview via Westpac:

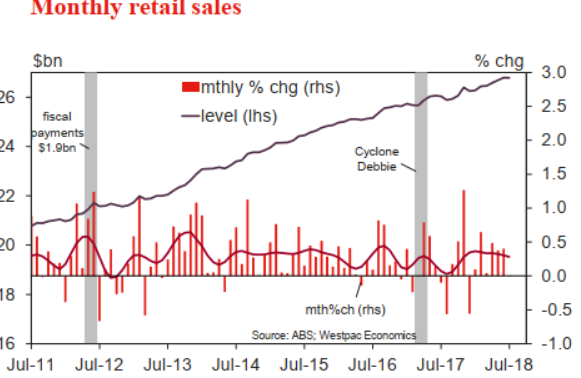

Retail sales were flat in July, a lacklustre result following a reasonably solid 1.3% bounce over the course of Q2.

- Sales have been choppy around a modest trend through the past year, some of the noise due to shifts in the timing of sales. Note that July was the first read post the extension of the GST to low value imported goods (including those purchased online). The change may have affected the competitiveness and pricing of local retailers although impacts are uncertain and may be slow to come through.

Indicators were on the soft side in August.

- Consumer sentiment remained in slight positive territory overall but slipped lower in the month, taking more of a lurch lower in September following leadership and mortgage rate changes.

- Private business surveys were mixed, retail responses to the NAB survey soft but AIG PSI suggesting holding up better. On balance, we expect August to show a 0.2% gain.

NAB have also previewed the data, comparing it with their in house indicator the NAB Retail Sales Index.

- NAB tip 0.0% change (flat) for the month but acknowledge an 'upside risk' to their forecast.

On implications of the data:

- Another soft monthly Retail Sales print would suggest that Q3 consumer spending will be relatively subdued, after a strong Q2 result. Further, with petrol prices sharply higher in September, spending is likely to face additional headwinds.

- The fear is that households, whose spending has been relatively resilient despite little real income growth, may start to reduce their consumption - slowing economic activity. This is something the RBA has stated it is watching closely, but there's little sign of these fears materialising as of yet- if anything year-ended retail sales growth has been on the rise