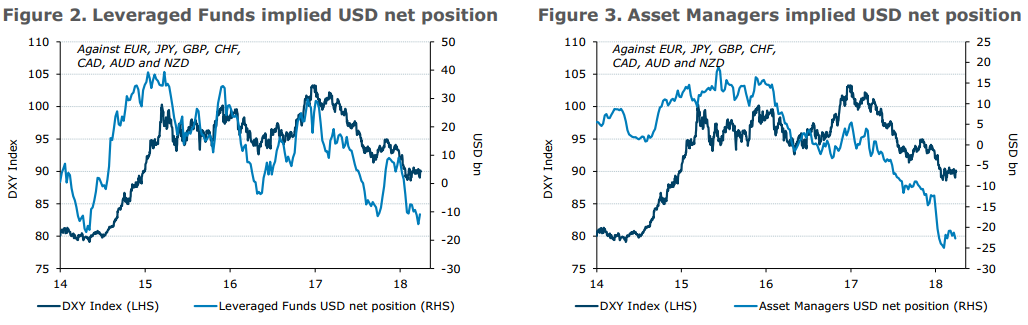

ANZ's look at the weekly US Commodity Futures Trading Commission (CFTC) data is a little different to what you'll find elsewhere:

- we use the combined futures and options position of Leveraged Funds as a proxy for leveraged positioning, where available

- We find that this typically has a slightly stronger correlation with the exchange rates that we are interested in compared to the more commonly used non-commercial futures positions

- We also report the positioning of Asset Managers (real money investors) who tend to use futures and options to hedge their underlying investment exposure

Summary of the latest report (for the week ending 27 March 2018) from the bank:

Leveraged funds turned net buyers of USD after two consecutive weeks of selling

- Funds trimmed their overall net short USD positions by USD3.5bn to USD10.8bn

- Real asset managers, however, turned net sellers of the USD, adding to their overall net short positions by USD1.4bn to USD22.7bn

- Nonetheless, overall net short USD positioning of both leveraged accounts and real asset managers remained at extreme levels, as DXY continued to hover around the lowest in three years. There are no signs yet of DXY breaking out of range-trading seen in the past two months

More:

JPY ... net buying of USD1.3bn by leveraged funds, in line with the price action in USD/JPY

- yen buying has extended into the 11th straight week

- Asset managers, however, trimmed their net long JPY positions by USD0.2bn to USD1.4bn, reversing the net buying in the week ago

GBP saw net buying by both leveraged funds and asset managers in the week

EUR too saw net buying, of USD0.1bn and USD2bn by funds and asset managers respectively, with the latter's net long EUR positioning touching a record high of USD25bn

Commodity currencies stood out as the key underperformer, led by CAD

- Funds sold USD5.2bn of CAD longs to turn into an overall net short position of USD2.7bn, the first time since early January

- Leveraged funds also cut their net AUD longs by USD0.7bn to USD1.6bn, partially reversing the net buying a week ago

- NZD saw marginal net buying of USD0.1bn to USD1.4bn, staying net long for the second consecutive week

- Asset managers too, were overall net sellers of commodity currencies for the second consecutive week