Latest from ANZ on commodities, with a focus on oil - this is in brief:

- escalating trade tensions continue to weigh on the commodity sector

- we view the oil market as the best sector in which to wait out the volatility

- Crude oil trade has so far been immune to the retaliatory tariff action, while its demand characteristics suggest it should withstand any impact.

- Moreover, its supply-side issues amid a backdrop of falling inventories should override any concern over weaker economic growth.

More:

- Aside from rising geopolitical risks, underlying supply issues should keep the crude oil market tight.

- Recent data suggest that outside the US, growth in supply is difficult to find.

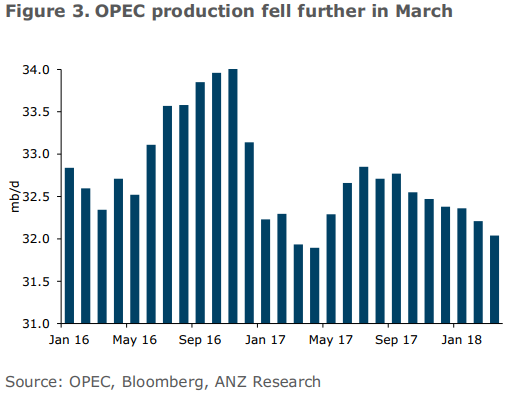

- OPEC output continues to fall, beyond the targets of the production cut agreement. There have also been delays in new projects in Angola and Brazil.

- We see downside risks to several producers. Libya ... Iran, Venezuela represents the biggest risk