Bank of America says they have become 'tactically bearish 'on stocks following the rally in the S&P 500

Note was distributed earlier this week, their 4 reasons:

Real risk of a second wave of infections

- cite South Korea (new cases linked to nightclubs)

- in the US cases still rising outside of New York

Investors are flying blind with more than 30% of S&P 500 companies withdrawing earnings guidance

- ratio of positive vs. negative sentiment on corporate earnings calls is the worst since 2012

Disconnect between the economy and equity marekts

- S&P 500 +30%, more than 36 million Americans lost jobs

- will fuel a rise in populist politics ahead of the US November election

Biggest risk is Congress being too slow to pass additional stimulus

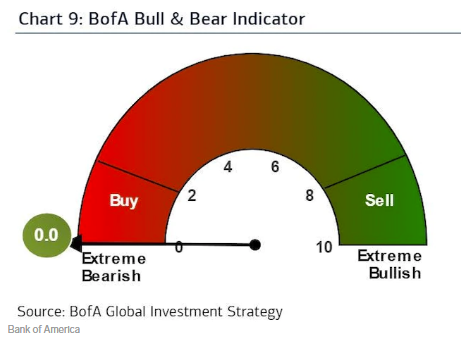

BoA do cite one reason to remain bullish though, sentiment is at an extreme bear reading, which is a tactically bull signal: