As intervention risks continue to stay heightened, there is plenty of uncertainty with regards to the USD/JPY outlook in the short-term. What is the trigger point for the ministry of finance (MOF) to take action? At what levels will they be comfortable with USD/JPY trading in the aftermath? Without any real change to the fundamental drivers, what happens when the pair rebounds higher after a few weeks/months?

The Takaichi trade is still the main risk for the Japanese yen at the moment and Tokyo officials certainly know that. The good news that they can bank on right now is that the US dollar is also at weak extremes and looking very vulnerable. And also the fact since the Bank of Japan (BOJ) meeting, the bond market has calmed down considerably.

So far, they have only gone as far as performing a couple of 'rate checks' since last Friday. That is keeping the yen currency from crumbling, with it having fallen alongside the dollar before that. But even so, all we're seeing is a push down in USD/JPY from 159.00 levels to 153.00 levels currently. The pair is still up 4% from the gap higher in early October, which marked the commencement of the Takaichi trade.

So, what happens now to USD/JPY?

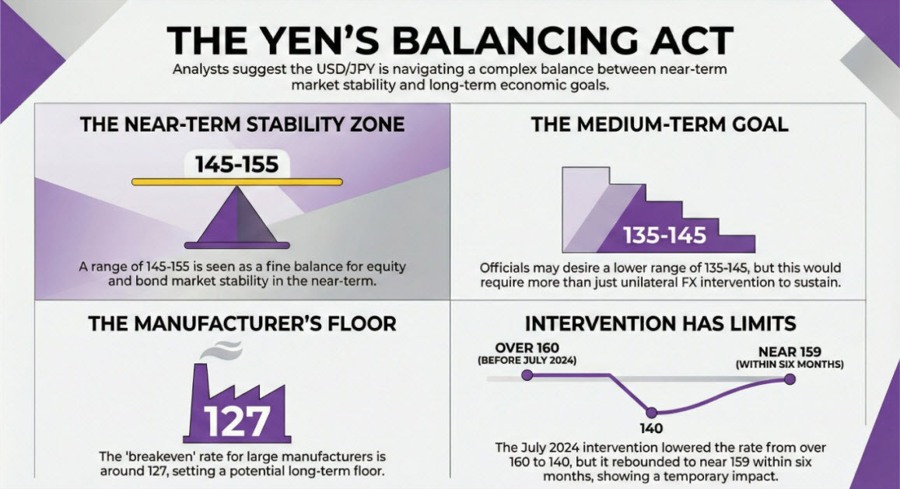

BofA argues that there is a balance to be struck and that might fit with a USD/JPY range of around 145 to 155 in the near-term.

"According to the Tankan survey, large manufacturers assume average USD/JPY rate for FY25 to be 146.50.. USD/JPY's drop below 145 appears undesirable in the near-term. 145-155 range may strike a fine balance between stability in the equity market and the bond market. However, a volatile selloff in USD/JPY below 150 could lead to a sharp selloff in equities, which increases the bar for intervention with USD/JPY below 155."

Looking further out, the firm notes that perhaps Tokyo officials might want the currency pair to keep lower than that. However, BofA says that it will be tough to sustain such a move with just intervention alone:

"In the medium-term, the government may be comfortable with a lower USD/JPY rate but not lower than manufactures' "breakeven" USD/JPY rate, which was 127 as of late 2024/early 2025. 135-145 may be a desired range though this would require something more than unilateral FX intervention."

As a reminder, Japan last intervened to prop up the yen currency back in July 2024. That helped to push USD/JPY down from above 160 to test 140 in about two months. But right after that, the pair managed a rebound all the way back up to near 159 by the time we got to January 2025.

That serves as a good anecdote that actual intervention doesn't always mean lasting impact, especially if not accompanied by a shift in fundamental drivers.