Venezuela itself has been largely compartmentalized. The market has been sniffing out attacks in Venezuela and potential regime change for awhile. There are still some really big questions about who is in charge and what the path is going forward but Venezuela itself is a small economy and even the oil impacts are small.

What's notable is after the initial risk move, the US dollar is now slumping. It's still a small move and goes alongside some strong gains in global equities. So likely this is the usual risk-positive USD slump.

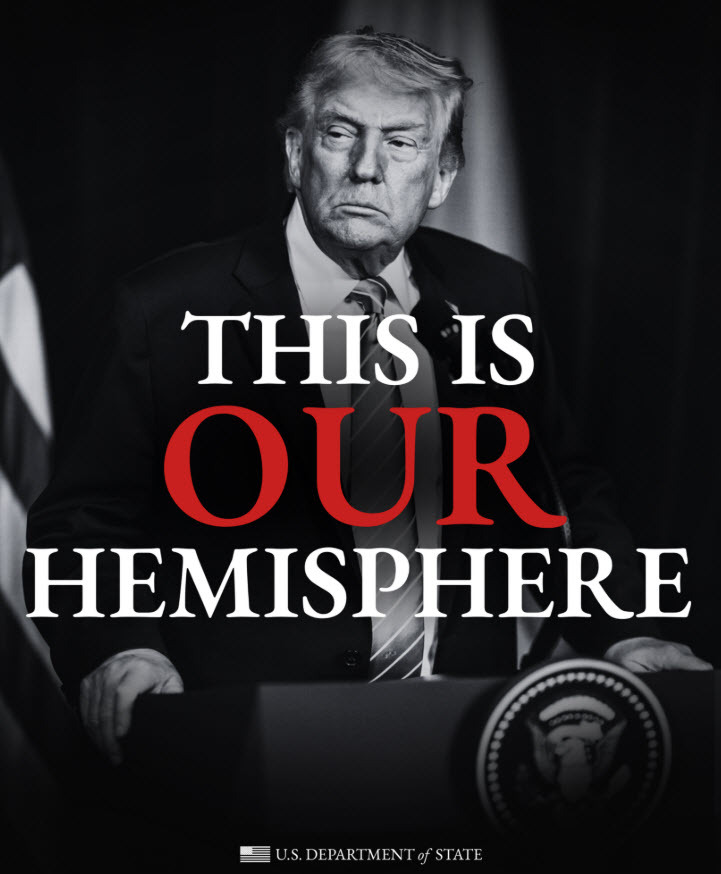

The thing about Venezuela and how the US just got away with a blatant violation of international law and norms with basically no pushback from the rest of the world.

For the US dollar, this changes the equation about 'what's next'.

Within hours of abducting Venezuela's leader, US officials were talking about regime change in Cuba and Columbia. Trump himself said the US needed Greenland for 'national security'.

Trump was also parading around with a hat saying "Make Iran Great Again".

Greenland in particular is sticky for Europe, as it's part of Nato. There would have to be repercussions in trade and the entire defense system.

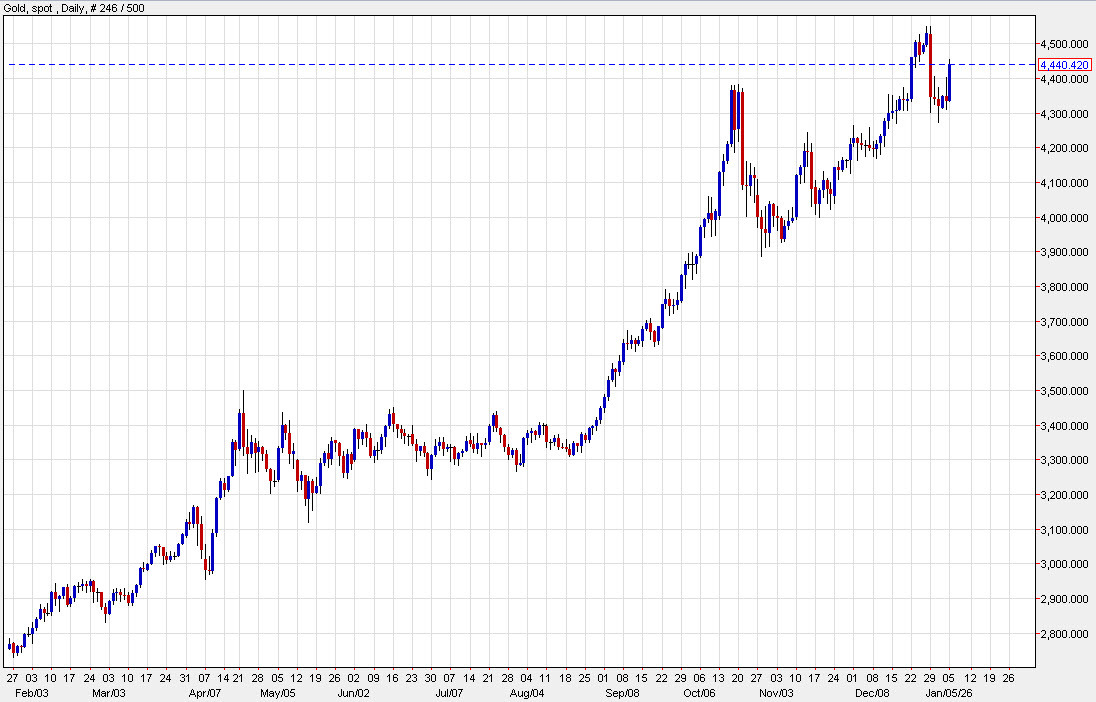

In terms of markets, these systems go hand-in-hand with US dollar dominance. If we take away the US from the center of the global free-market system, then what is the system? The US already seized Russia's dollar assets and now it's getting more adventurous. That's a big reason why gold went parabolic in the past year and is up 2.5% today.

In terms of today's price, the US dollar climbed early in the day but has since reversed course and is at the lows of the day. What's important to remember is that US dollar usage globally was maxed out. China, Middle Eastern countries and countries unfriendly with the US have every reason now to de-dollarize. Even Denmark now has to question whether it should continue to hold US dollars? The country holds $91.8 billion in foreign exchange reserves and the composition is confidential but USD reserves hare likely the majority. Why not swap those to euros, pounds and gold instead?