Fundamental Overview

The USD has been stronger across the board since the hawkish turn from Fed Chair Powell at the last FOMC press conference. The repricing in interest rate expectations acted as a tailwind for the greenback as Treasury yields continued to push higher.

Yesterday, we got a couple of strong US data. The US ADP beat forecasts (although that was expected) and the ISM Services PMI came in much better than expected with the price index pushing into a new cycle high.

Despite the strong data, the greenback failed to extend the rally. This is generally a signal of a short-term top with the market needing more to keep the trend going. In fact, the market pricing is now showing a 60% probability of a December cut, which is just right. The data in December will probably have the final say and hopefully we will get an NFP and CPI report before the next FOMC decision.

On the JPY side, the currency has been weakening since last BoJ policy decision where the central bank left interest rates unchanged as expected with again two dissenters voting for a hike. There were no surprises but Governor Ueda focusing on spring wage negotiations suggested that the next hike could be delayed to January or even March 2026.

We got some verbal intervention this week from the Japanese Finance Minister near the 155.00 handle. This is generally just short-term stuff that provides pullbacks for traders as long as the conditions for more yen weakness persist. But it shows that the 155.00 level is where the Japanese officials start to draw a line.

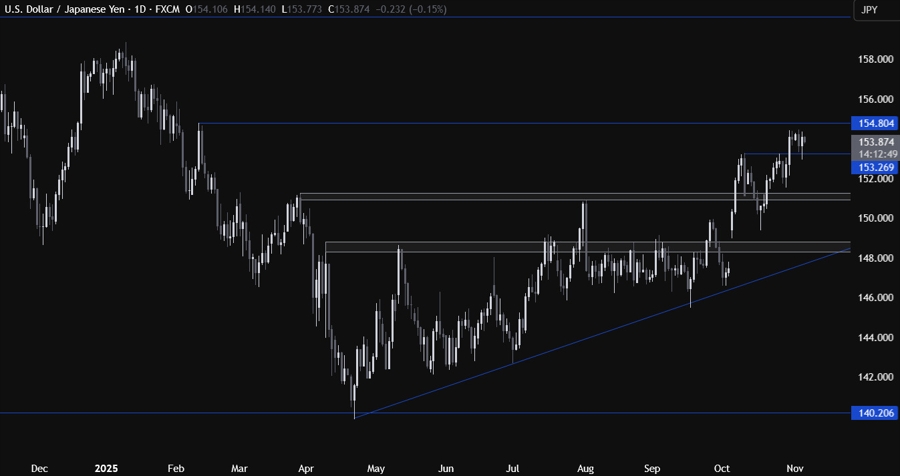

USDJPY Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDJPY pulled back into the 153.27 level and bounced as the buyers stepped in with a defined risk below the level to position for a rally into new highs. The sellers will want to see the price breaking lower to pile in for a drop into the 151.00 support next.

USDJPY Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see more clearly the bounce around the 153.27 level and the upward trendline. If we get another pullback, we can expect the buyers to lean on the trendline again to keep pushing into new highs, while the sellers will look for a break lower to extend the pullback into the 151.00 support next.

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, there’s not much else we can add here, but we can see that we have a minor counter-trendline that could turn into a bullish flag in case the price breaks above it. From a risk management perspective, the buyers will have a better risk to reward setup around the major trendline, while the sellers will likely need a downside breakout to increase the bearish momentum. The red lines define the average daily range for today.

Upcoming Catalysts

Tomorrow we conclude the week with the US University of Michigan Consumer Sentiment report.