Fundamental Overview

The USD came under some renewed pressure yesterday following the US CPI report. The data was mostly in line with forecasts and not strong enough to deter the market from expecting a cut in September.

In fact, the pricing actually increased to 60 bps of easing by year-end compared to 57 bps before the CPI release. This just shows that the market is now very confident on a September cut and fully prices in at least another one before the end of the year.

A September cut looks unavoidable now and only a hot NFP report in September might get us to a 50% probability, although it would certainly diminish expectations for rate cuts after the September one. For August, we have now just Fed Chair Powell’s speech at the Jackson Hole Symposium as the next major event. Traders will be eager to see if he changes his stance as well.

On the JPY side, the currency has been rallying on the back of the dovish expectations for the Fed. For more JPY appreciation we will need weak US data to increase the dovish bets on the Fed or higher inflation figures for Japan to price in more rate hikes than currently expected. Other potential positive driver could be signs of more fiscal support as that will likely put upward pressure on inflation.

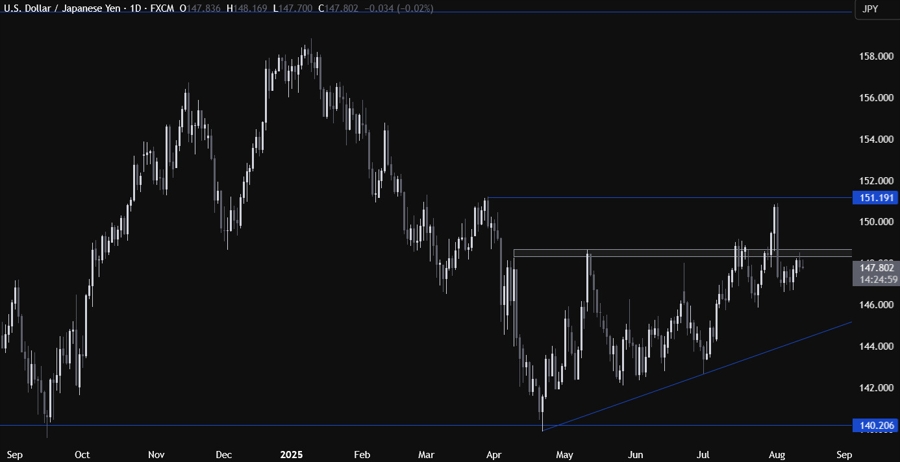

USDJPY Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDJPY is still consolidating around the 148.00 handle as the US CPI didn’t offer any reason to bid up the greenback further. The sellers will likely continue to pile in around these levels with a defined risk above the 148.50 zone to position for a drop into the major trendline. The buyers, on the other hand, will want to see the price breaking above that resistance zone to increase the bullish bets into the 151.00 handle next.

USDJPY Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see more clearly the consolidation around the resistance and the rejection after the US CPI report. There’s not much we can add here as the sellers will keep on pushing towards the major trendline around the 144.50 level, while the buyers will wait for a break above the resistance to pile in more aggressively into the 151.00 handle.

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that the dollar is coming under renewed pressure today as the bearish momentum from the US CPI looks set to continue until the next catalyst. A break below the most recent low at 147.58 could should see the sellers increasing the bearish bets into new lows. The red lines define the average daily range for today.

Upcoming Catalysts

Tomorrow we get the US PPI and the US Jobless Claims figures. On Friday, we conclude the week with the US Retail Sales and the University of Michigan Consumer Sentiment report. Focus also on Fedspeak, especially after yesterday's US CPI data.