Fundamental Overview

The USD eventually erased all the CPI gains as the US inflation figures weren’t enough to trigger a more hawkish repricing in interest rates expectations. The market is still expecting roughly two rate cuts by year-end for the Fed. Overall, we are just in rangebound mode given the lack of meaningful changes in conditions in the past few weeks.

On the JPY side, the ruling bloc lost the majority in the upper house which makes striking a trade deal with the US more complicated. Traders will now focus on how the political landscape changes. Options include a new PM (although Ishiba said he will continue), new alliances and so on. The key things to watch is how political shifts will change expectations for fiscal policy and trade negotiations with the US.

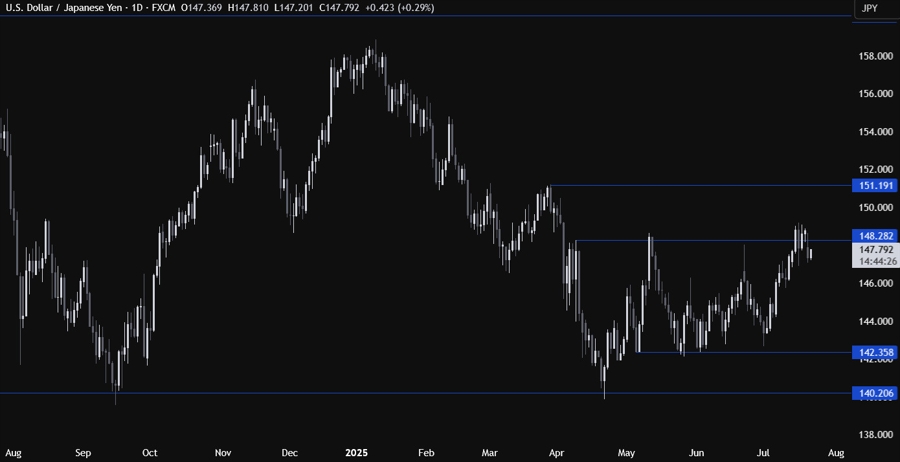

USDJPY Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDJPY couldn’t sustain the rally above the key 148.30 resistance and eventually fell back below the level. The sellers will likely keep on piling in around these levels with a defined risk above the resistance to position for a drop into the 142.35 support. The buyers, on the other hand, will want to see the price breaking above the resistance again to start targeting the 151.20 level next.

USDJPY Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we had an upward trendline defining the bullish momentum. The price broke below the trendline, which might be a signal of a change in the short-term trend. We have a minor support zone around the 147.00 handle which the sellers will need to break through to increase the bearish bets into new lows. The buyers, on the other hand, will likely keep on leaning on the support to target new highs.

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, there’s not much else we can add here as the buyers will look for dip-buying opportunities around the support, while the sellers will look for a downside breakout to push into new lows. The red lines define the average daily range for today.

Upcoming Catalysts

Today we have Fed Chair Powell speaking but given the blackout period, he won’t comment on monetary policy. On Thursday, we get the Japanese and US Flash PMIs, and the latest US Jobless Claims figures. On Friday, we conclude the week with the Tokyo CPI.