Fundamental Overview

The USD remains strong across the board following the hawkish turn from Fed Chair Powell last week. The repricing in interest rate expectations acted as a tailwind for the greenback as Treasury yields rose and continue to trade at the recent highs.

Yesterday, we got a slightly weaker than expected ISM Manufacturing PMI report. Businesses continue to blame the tariff policy. Maybe the October US-China trade war weighed a bit on sentiment, so we will see if next month’s report shows the same downbeat mood.

On the JPY side, the currency has been weakening since last week’s BoJ policy decision where the central bank left interest rates unchanged as expected with again two dissenters voting for a hike. There were no surprises but Governor Ueda focusing on spring wage negotiations suggested that the next hike could be delayed to January or even March 2026.

Today, the yen strengthened across the board following some verbal intervention from the Japanese Finance Minister. This is generally just short-term stuff that provides pullbacks for traders.

USDJPY Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDJPY broke above the key resistance around the 153.27 level and now pulled back to retest it following the Japanese verbal intervention. This is where we can expect the buyers to step in with a defined risk below the 153.27 level to position for a rally into the 156.00 handle next. The sellers, on the other hand, will want to see the price breaking lower to start targeting the 151.00 support zone.

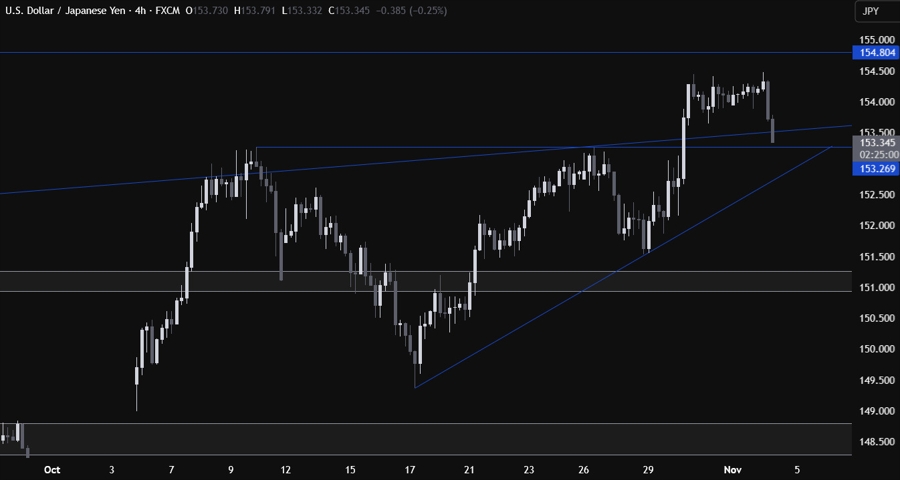

USDJPY Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see more clearly the pullback into the 153.27 level. We can see that we have also an upward trendline defining the upward momentum. If the price extends the drop past the 153.27 level, we can expect the buyers to lean on the trendline with a defined risk below it to keep pushing into new highs. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the 151.00 support next.

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, there’s not much else we can here as the buyers will likely pile in around the 153.27 level and the trendline to keep targeting new highs, while the sellers will look for downside breaks to push into new lows. The red lines define the average daily range for today.

Upcoming Catalysts

Tomorrow we have the US ADP report and the US ISM Services PMI. On Thursday, we get the Japanese wage growth data. On Friday, we conclude the week with the US University of Michigan Consumer Sentiment report.