Fundamental Overview

The USD has strengthened since Friday as Treasury yields bounced following some positive Trump’s comments on China. Overall, the US dollar performance has been mixed as markets have been driven by quick changes in risk sentiment given the lack of US data.

On the domestic side, the US government shutdown continues to delay many key US economic reports. Today though, we will get the US CPI data since it’s crucial for social security benefits adjustment required by November.

The dollar “repricing trade” needs strong US data to keep going, especially on the labour market side, so any hiccup on that front should keep weighing on the greenback.

Since Trump’s threat of massive tariffs on China, the market pricing turned more dovish with 119 bps of easing seen by the end of 2026 (the Fed projected just 75 bps). Therefore, if we de-escalate further and the US data picks up, there should be plenty of room for the greenback to appreciate.

On the JPY side, the currency strengthened recently on the risk-off sentiment that got triggered by Trump’s tariffs threat but eventually gave back most of the gains as things de-escalated. Domestically, Takaichi became Prime Minister, and we saw some more weakness in the yen as traders continue to expect the BoJ to delay rate hikes.

Today’s Japanese Core CPI came in line with expectations at 2.9% which is in the BoJ range of 2.5%-3.0% projection for 2025. The market sees just a 40% probability of a rate hike by year-end.

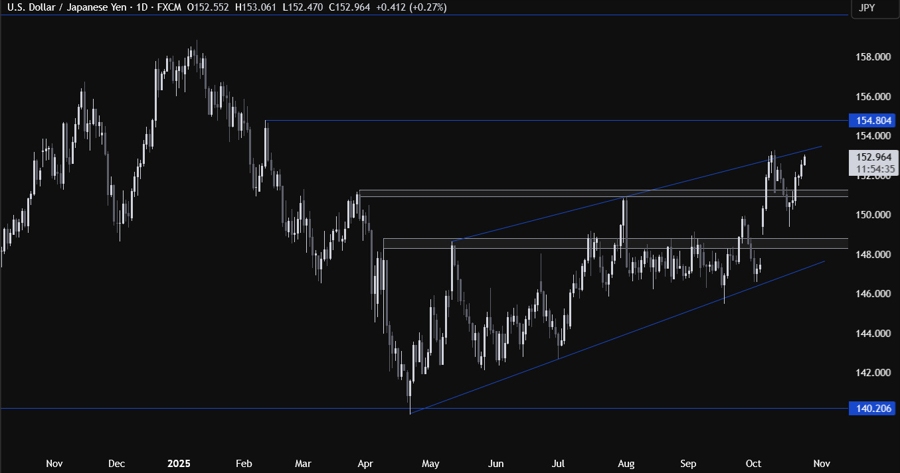

USDJPY Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDJPY eventually rallied back into the 153.00 handle and it’s now close to the top trendline. This is where we can expect the sellers to step in with a defined risk above the trendline to position for a drop back into the 151.00 support. The buyers, on the other hand, will want to see the price breaking higher to extend the rally into the 154.80 level next.

USDJPY Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we have an upward trendline defining the bullish momentum. The buyers will likely continue to lean on the trendline with a defined risk below it to keep pushing into new highs, while the sellers will look for a break lower to pile in for a drop into the 151.00 support.

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, there’s not much else we can add here as the sellers will look for shorts around the 153.26 level and below the upward trendline, while the buyers will look for longs above the 153.26 level or around the upward trendline. The red lines define the average daily range for today.

Upcoming Catalysts

Today, we conclude the week with the US CPI report and the US flash PMIs.