KEY POINTS:

- Japanese PM Takaichi weighs calling snap election to restore LDP majority

- US DOJ subpoena renewed Fed independence worries and weighed on the dollar

- Japanese data not pointing to any urgent action on monetary policy

- US CPI in focus today

- USDJPY rises to the highest level since July 2024

FUNDAMENTAL OVERVIEW

USD:

The US Dollar weakened across the board yesterday following the news of the US Department of Justice subpoenaing the Federal Reserve. The market saw the move as another attack against Fed independence amid Trump’s calls to lower interest rates faster.

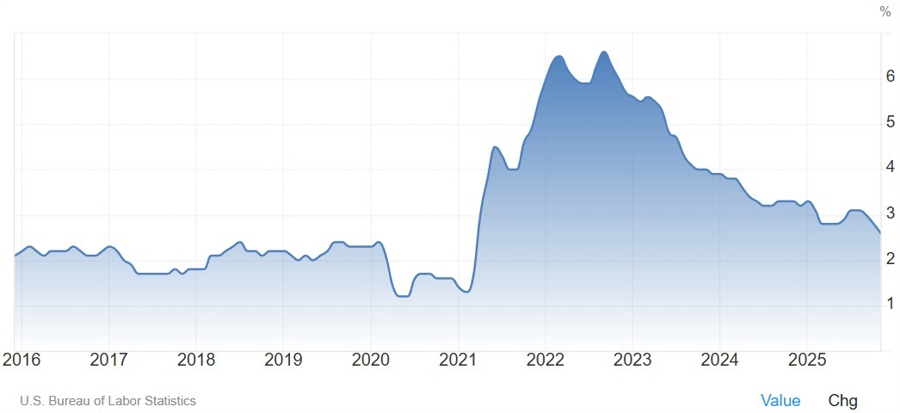

A potential loss of Fed independence increases the risk of uncontrolled inflation in the future and currency debasement. The probability of the loss of Fed independence though remains very low as the consequences would be too big not only for the US but the global economy as a whole. So, for now it’s just noise, but the market will keep an eye on that risk.

Today, we have the US CPI report, and it could be a major market-moving release. A hot report will likely trigger some hawkish repricing in interest rate expectations and support the US Dollar. On the other hand, soft data should keep the market on expecting at least two rate cuts by the end of the year potentially weighing on the greenback.

JPY:

On the JPY side, we got reports on Friday that Japanese PM Takaichi was considering dissolving the lower house and calling a snap election in February to restore her LDP majority given the high approval rating. This would potentially give her more leeway on policy.

The Japanese Yen weakened following the reports and, after a brief consolidation, resumed the fall despite continuous verbal intervention from Japanese officials. Moreover, the economic data hasn’t been pointing to any urgent action from the BoJ. The latest wage data disappointed and the Tokyo CPI in December was softer than expected. Inflation has been hovering above the BoJ’s 2% target but never showed concerning developments.

The central bank is still placing a great deal on wage growth, so wage data and spring wage negotiations remain key. The market is pricing around 40 bps of tightening by year end. The outlook for the JPY remains bearish.

USDJPY TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that USDJPY eventually extended the rally into the 158.87 level. This is where we can expect the sellers to step in to position for a drop back into the 154.50 support. The buyers, on the other hand, will want to see the price breaking higher to increase the bullish bets into the 161.95 level next.

USDJPY TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see that we have an upward trendline defining the bullish momentum. If we get a pullback into the trendline, we can expect the buyers to lean on it with a defined risk below it to keep targeting new highs. The sellers, on the other hand, will look for a break lower to pile in for a drop into the 154.50 support next.

USDJPY TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see that we have another minor upward trendline defining the bullish momentum on this timeframe. From a risk management perspective, the buyers will have a better risk to reward setup around the trendline to keep pushing into new highs, while the sellers will look for a break lower to target the next trendline around the 157.00 handle. The red lines define the average daily range for today.

UPCOMING CATALYSTS

Today we have the US CPI report. Tomorrow, we get the November US Retail Sales and US PPI reports, so it’s going to be old data. We also have a potential US Supreme Court decision on Trump’s tariffs tomorrow. On Thursday, we get the latest US Jobless Claims figures.