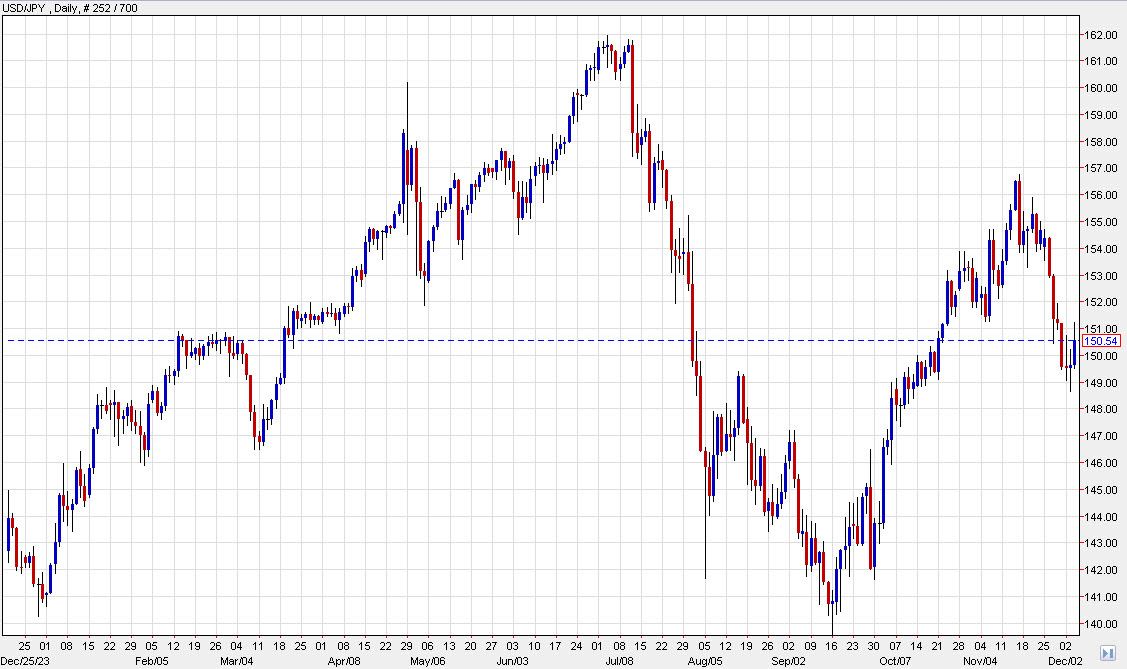

USD/JPY is down 167 pips to the lows of the day.

It's been volatile trading so far today as the pair initially traded near these levels befoer bouncing by more than 100 pips. In the past two hours though, it began trending lower and has now taken out the lows.

The drop today takes the pair through a December double bottom near 154.30 and that highlights the possibility of a trend change. If you zoom out, the reversals in this pair, particularly the ones lower lately have been big and aggressive. The July 2024 reversal is instructive as it also started near 160 and continued down to 141 less than a month later.

That move was kicked off by actual intervention from Japanese officials.

So far we haven't seen that, but just now Japan's chief cabinet secretary said they are closely watching market moves with a high sense of urgency. Kihara also said they will take appropriate action based on the Sept j int statement with US officials. That statement wasn't overly notable at the time but in it, the United States and Japan reaffirmed their commitment to "market determined" exchange rates.

He declined to comment about JGB moves are reports of a rate check.

The latest move lower in USD/JPY is part of a larger selloff in the US dollar but the moves are particularly large in USD/JPY, likely reflecting the crowded nature of long bets in that pair. Over in the precious metals market, gold and silver are making historical moves as the market seemingly loses confidence in USD reserves.

Amidst all this, the bond market is relatively stable. Should it come unmoored, the volatility could spill into equities and cause some larger problems. Odds of another US government shutdown are currently spiking and that won't be welcomed by any equity market but the yen would be an FX winner if it means risk off and USD selling.