Fundamental Overview

The USD has been weak across the board in the first part of this week with quarter-end flows and US government shutdown likely weighing on the price action. In fact, given the higher probability of key US data like the NFP and CPI being delayed and therefore the Fed not skipping a rate cut in October, the market priced out some of the hawkishness from last week.

The dollar “repricing trade” needs strong US data to keep going, especially on the labour market side, so any hiccup on that front is likely to keep weighing on the greenback. The market pricing is now back to 44 bps of easing by year-end and 107 bps by the end of 2026. This could still be too dovish but we will need strong data to reprice.

On the JPY side, we haven’t got any meaningful change in fundamentals in the meantime. The BoJ kept interest rates unchanged as expected at the last meeting, but the market got surprised by two members voting for a rate hike. The yen initially rallied but once Governor Ueda started speaking, the gains began to fade and eventually got erased completely as Ueda downplayed the dissenting votes. The yen has been mostly driven by dollar strength/weakness.

USDJPY Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDJPY fell back below the key 148.50 level and extended the drop as the sellers piled in with more conviction to target the major trendline around the 146.50 level. If the price gets there, we can expect the buyers to lean on the trendline with a defined risk below it to position for a rally into the 151.00 handle. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the 143.00 handle next.

USDJPY Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we have a downward trendline defining the bearish momentum. The sellers will likely continue to lean on the trendline with a defined risk above it to keep pushing into new lows, while the buyers will look for a break higher to pile in for a rally into new highs.

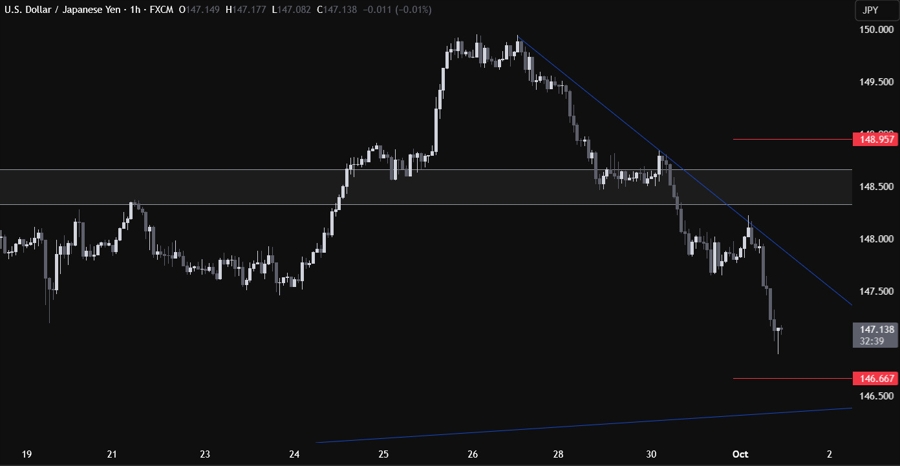

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, there’s not much else we can add here as the sellers will be better off shorting from the trendline, while the buyers will either wait to buy the dip around the major trendline or look for a break above the minor downward trendline to target new highs. The red lines define the average daily range for today.

Upcoming Catalysts

Today we have the US ADP and the US ISM Manufacturing PMI. Tomorrow, we get the latest US Jobless Claims figures. On Friday, we conclude the week with the US NFP report and the US ISM Services PMI. Keep also an eye on Fed speakers.