USD/JPY has been in a steady uptrend since cratering early in the year due to Trump's tariff agenda. It bottomed just after Liberation Day in April and has steadily climbed 1300 pips.

There are certainly concerns about Japanese policy baked into the yen trade but I think tariffs and trade are the best lens to look at the pair. After the insanity of Liberation Day, Trump's administration has steadily taken down tariffs and carved out exemptions, generally landing around 15% tariffs like he did today with Switzlerland.

The big risk going forward is that the Supreme Court invalidates this round of tariffs altogether. That would lead to some tinkering with different tariff tools and uncertainty but it would generally add to the USD/JPY momentum.

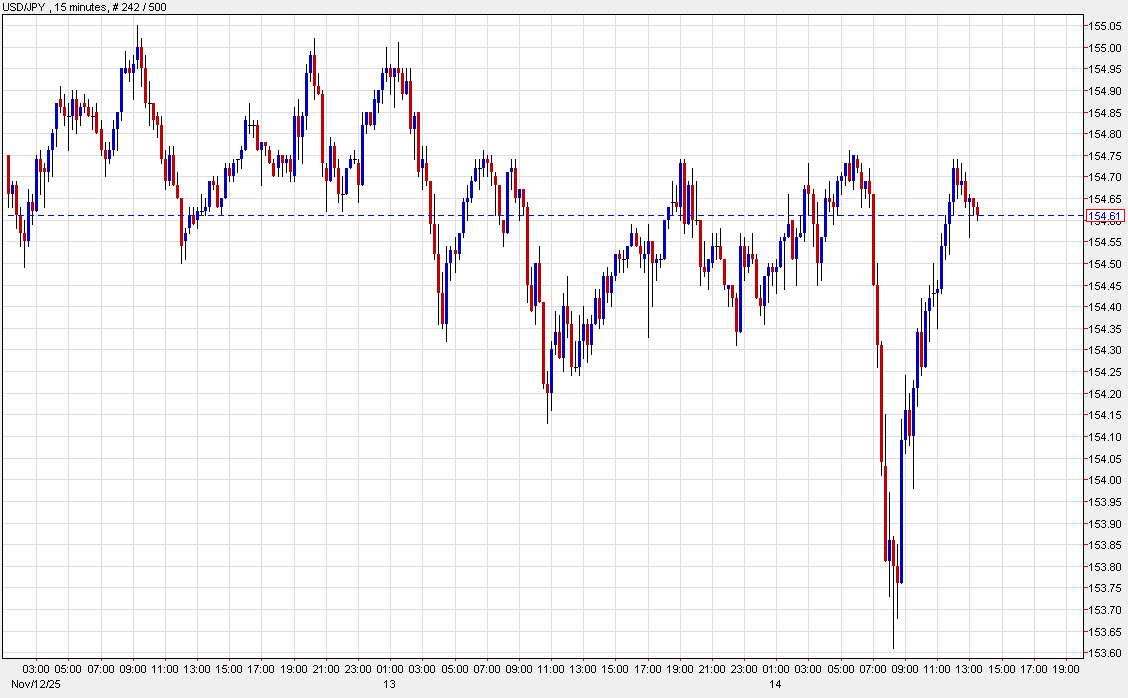

For today, USD/JPY tracked the risk trade and equities as it slumped hard in the early going of New York trade only to completely recover. Similarly, the S&P 500 is now also slightly higher, erasing a big decline.