USD/JPY is down heavily for the second straight day following Takaichi's election win. The two-thirds majority in the lower House gives her wide latitude to govern and has led to a flood of money into Japanese equities. The Nikkei is up 7% in two trading days and USD/JPY reflects some of that enthusiasm as money flows out of dollars and into yen.

Japan faces a debt problem but a strong government gives Takaichi stability and the ability to structurally reform the economy where necessary, including making unpopular moves. She had campaigned on more stimulus though, so the market will be carefully watching for actual policies.

Yesterday's drop in the pair was more driven by broad USD selling but today the yen is a standout performer. EUR/JPY and GBP/JPY are both down more than 1% and the yen is the top G10 performer.

Still, there are worries about the US dollar in light of recent data. A series of secondary jobs numbers last week were soft and today's US retail sales report was weak. Tomorrow we get the December non-farm payrolls report and the consensus is +70K. That sound rich in light of weak ISM services employment and a sharp drop in job openings in the JOLTS report.

Later today, we will get an update from the Atlanta Fed GDPNow tracker and it's likely to show that Q4 GDP is on pace for a sub-4% reading. That high-3s is still good but it shows the direction of change for a quarter that had some predicting a +5% reading.

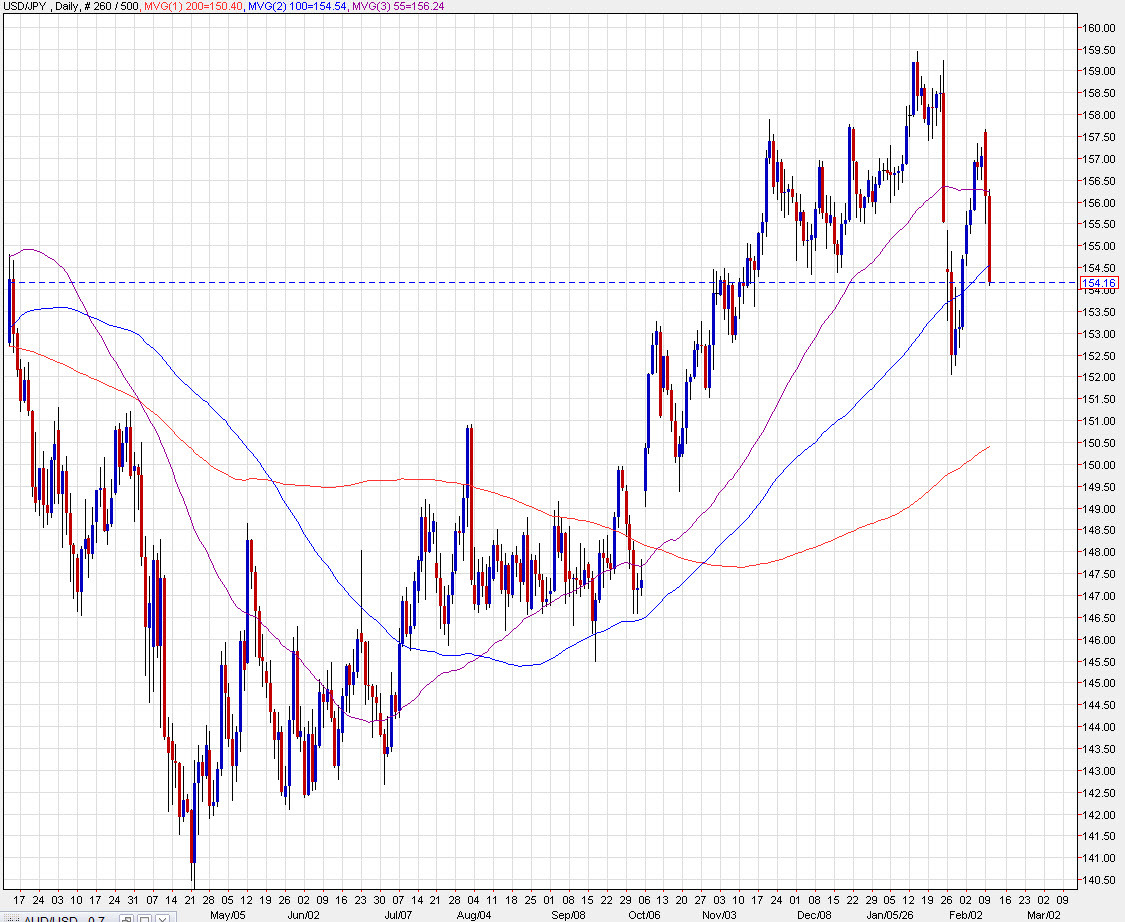

In terms of the chart, USD/JPY is now through the 100-day moving average and could target the January low of 152.27. The 200-day moving average is at 150.39 beyond that.

Beyond the jobs report, eyes will be on Friday's CPI report and the possibility the FOMC could have more leeway to cut rates.