Fundamental Overview

The USD came under some pressure at the start of last week following the US CPI report as the data came mostly in line with expectations. In the following days though, we got some hottish data with the US PPI beating expectations by a big margin, the US Jobless Claims improving further and the inflation expectations in the UMich survey surprising to the upside.

Overall, we ended the week basically flat on the US dollar as the aggressive dovish expectations on the Fed got trimmed a bit. Nevertheless, given the overreaction from the Fed members to the last soft NFP, a September cut looks unavoidable now and only a hot NFP report in September might get us to a 50% probability (although it would certainly diminish expectations for rate cuts after the September one).

The focus has now switched to Fed Chair Powell’s speech at the Jackson Hole Symposium on Friday. Traders will be eager to see if he changes his stance as well. Most likely though, he won’t pre-commit to anything and just reiterate that they will decide based on the totality of the data.

On the CHF side, we haven’t got anything new in terms of monetary policy as the SNB is now in a long pause. The latest Swiss CPI showed a slight improvement in inflation although it’s not important as the central bank will not hike rates for a long time. The market doesn’t expect the SNB to cut anymore.

There’s some focus at the moment on the 39% tariffs that the US slapped on Switzerland. That is likely to be resolved in the near future with the rate being set between 10-20% as we’ve seen for most other countries.

USDCHF Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDCHF is trading at the key support zone around the 0.8050 level. The buyers will likely continue to step in around the support with a defined risk below it to keep targeting the 0.84 handle next. The sellers, on the other hand, will look for a break lower to increase the bearish bets into new cycle lows.

USDCHF Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we’ve been consolidating ever since the dollar selloff triggered by the soft NFP report. The price action formed what looks like a descending triangle. The price can break on either side of the pattern but what follows next is generally a sustained trend in the direction of the breakout.

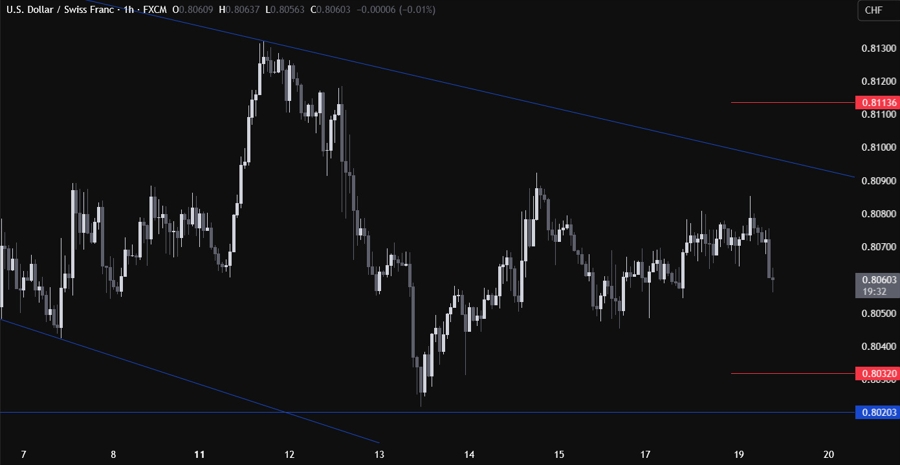

USDCHF Technical Analysis – 1 hour Timeframe

On the 1 hour chart, there’s not much we can add here as the rangebound price action is likely to persist until Powell’s speech or the NFP report. From a risk management perspective, the sellers will have a better risk to reward setup around the trendline, while the buyers would be better off stepping in around the 0.8020 support. The red lines define the average daily range for today.

Upcoming Catalysts

Tomorrowwe have Fed’s Waller speaking and the FOMC meeting minutes. On Thursday, we get the US Flash PMIs as well as the US Jobless Claims figures. Finally, on Friday, we conclude the week with Fed Chair Powell speech at the Jackson Hole Symposium.