Fundamental Overview

The USD came under renewed pressure last Thursday following an in-line US CPI report and surprisingly weak initial jobless claims. The jobless claims data stole the show as initial claims jumped to a new cycle high and the highest level since 2021.

Eventually, it turned out that the spike in initial claims was caused by an increase in fraudulent claim attempts in Texas. Therefore, in light of this new information, jobless claims still point to a resilient labour market and the fall in continuing claims could actually be an early signal of improvement.

Overall, if one zooms out, the US dollar has been mostly rangebound even though the dovish bets on the Fed kept weighing on the currency. Part of that could be the fact that the bearish positioning on the dollar could be overstretched and we might be at the peak of the dovish pricing.

In fact, if the rate cuts trigger stronger economic activity in the next months, the rate cuts in 2026 could be priced out and support the dollar. For now, the trend is still skewed to the downside, and we might need strong data to reverse it.

On the CHF side, we haven’t got anything new in terms of monetary policy as the SNB has ended its easing cycle. The last Swiss CPI showed a slight improvement in inflation but even if we get more such reports, it won’t change anything for the SNB given that there’s a long way to go before breaching their 2% inflation limit. On the other hand, the central bank is very reluctant to cut rates into negative territory, so this leaves the CHF trading based on weakness and strength of other currencies.

USDCHF Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDCHF fell all the way back to the key swing level around the 0.79 handle. This is where we can expect the buyers to step in with a defined risk below the level to position for a rally into the major trendline around the 0.80 handle. The sellers, on the other hand, will want to see the price breaking lower to increase the bearish bets into a new cycle low.

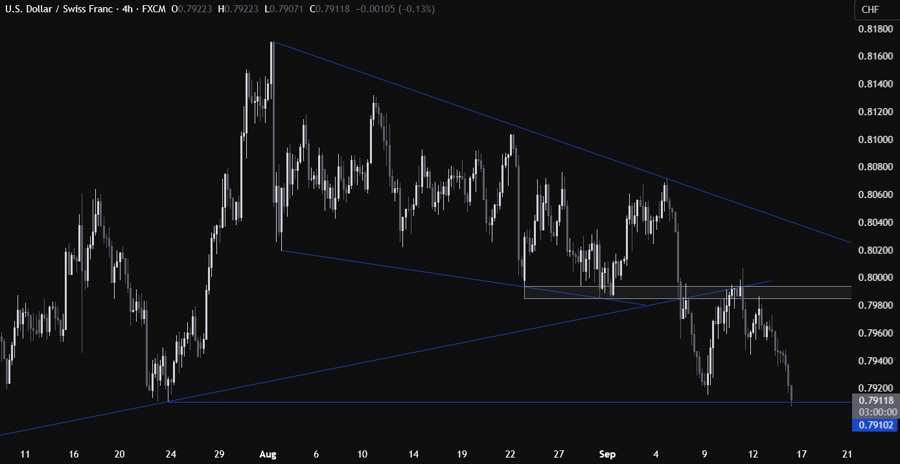

USDCHF Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we got the pullback into the 0.7990 resistance zone last week and then we started to roll over following the US CPI and jobless claims reports. The sellers maintained control as the dovish positioning into the FOMC remained intact given the lack of new catalysts. There’s not much else we can glean from this timeframe as the buyers will look to buy the dip at these levels, while the sellers will look for a break lower to extend the drop into new lows.

USDCHF Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that we have a minor downward trendline defining the bearish momentum. If we get a pullback into the trendline, we can expect the sellers to lean on the trendline with a defined risk above it to position for a move into new lows. The buyers, on the other hand, will look for a break higher to increase the bullish bets into the 0.7970 resistance next. The red lines define the average daily range for today.

Upcoming Catalysts

Today we get the US Retail Sales data. Tomorrow, we have the FOMC policy announcement. On Thursday, we get the lates US Jobless Claims figures.