FUNDAMENTAL OVERVIEW

USD:

The US Dollar spiked higher yesterday following a strong US NFP report as the market pared back slightly Fed rate cut bets but surprisingly gave back all the gains. Maybe the market is still too convinced of more labour market weakness to come, or it decided to wait for the US CPI. Whatever the reason, the data since the start of the year has been clearly pointing to improving conditions that do not justify further rate cuts.

The focus now turns to the US CPI report coming up tomorrow. If we get hot data, I can’t see how the market could brush that off like it did with the NFP. The hawkish repricing will likely be more substantial and trigger a more sustained rally in the greenback. On the other hand, soft data shouldn’t change much in terms of market pricing but could keep the dollar under pressure.

CAD:

On the CAD side, the currency weakened yesterday following a Bloomberg report saying that US President Trump was privately weighing quitting the USMCA deal. Canada maintains generally low tariffs on most US goods due to USMCA, so if Trump were to exit the trade pact, tariffs for Canada would rise substantially and negatively affect the economy.

Bloomberg added that “the president has asked aides why he shouldn’t withdraw from the agreement, although he has stopped short of flatly signalling that he will do so”. For the CAD, the USMCA negotiations remain key, so negative or positive news on that front will continue to move the currency.

On the monetary policy front, the BoC remains in a neutral stance with the market not pricing any move through year-end. The economic data has been supportive of such stance with the labour market stabilising and core inflation hovering a bit above the 2.5% mid-point of the BoC 2-3% target range.

USDCAD TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that USDCAD probed below the 2025 low two times but failed to sustain a breakout. The buyers will likely continue to step in around the lows to target a pullback into the major trendline. The sellers, on the other hand, will look for a break lower to increase the bearish bets into new lows.

USDCAD TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see the price broke above a downward trendline that was defining the bearish momentum. This might give the buyers more conviction to keep piling in for a pullback into the major trendline with the 1.3723 high as the first target. The sellers, on the other hand, will look for a break below the recent low to extend the drop into new lows.

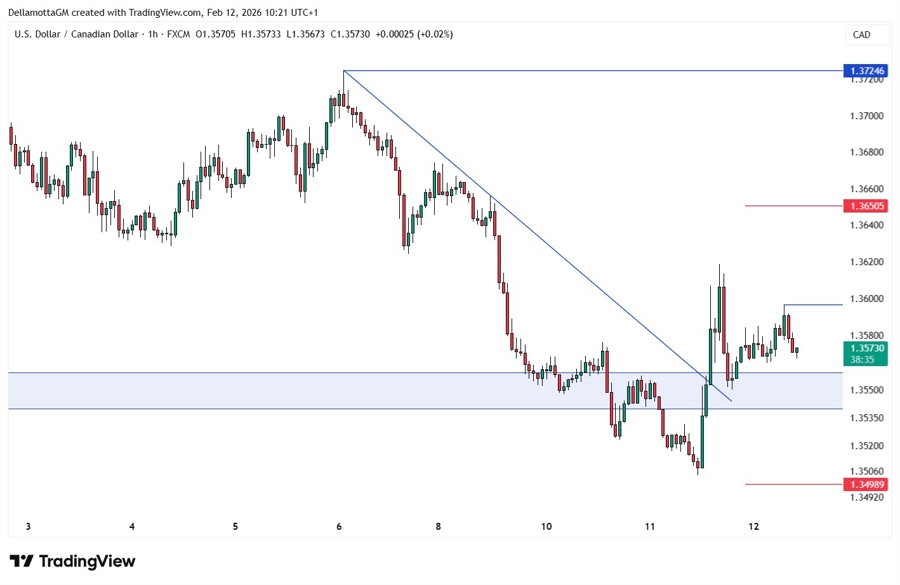

USDCAD TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see a consolidation after the USMCA news and the hot NFP report as traders await the US CPI report coming up tomorrow. From a risk management perspective, the buyers will have a better risk to reward setup around the 1.3550 level to position for a rally into the 1.3723 high. The sellers, on the other hand, will want to see the price breaking below the 1.3550 support to pile in for a drop into new lows. The red lines define the average daily range for today.

UPCOMING CATALYSTS

Today we get the US Jobless Claims figures, while tomorrow we conclude the week with the US CPI report.