The US dollar is at the lows of the day across most of the foreign exchange market.

The possibility of a fresh trade war is coming into focus as the US President grows increasingly erratic in insisting the US annex Greenland. That's setting up a battle with the EU and the potential for a financial showdown, including counter tariffs.

It's hard to see what the end game is here but there's always the potential for Europe to roll over or for Congress to step in and put an end to this. If it escalates, there are trillions of dollars of USD assets held in Europe and you have to think that central banks will be less inclined to hold US dollars.

These systems are so intertwined that it could be catastrophic for many businesses if there is a genuine schism. For Denmark, the central bank doesn't publish its reserve holdings but has $98 billion in assets and typically those are around 50% in US dollars. They may consider selling that.

Those kinds of flows may help to explain why the US dollar is under some pressure today.

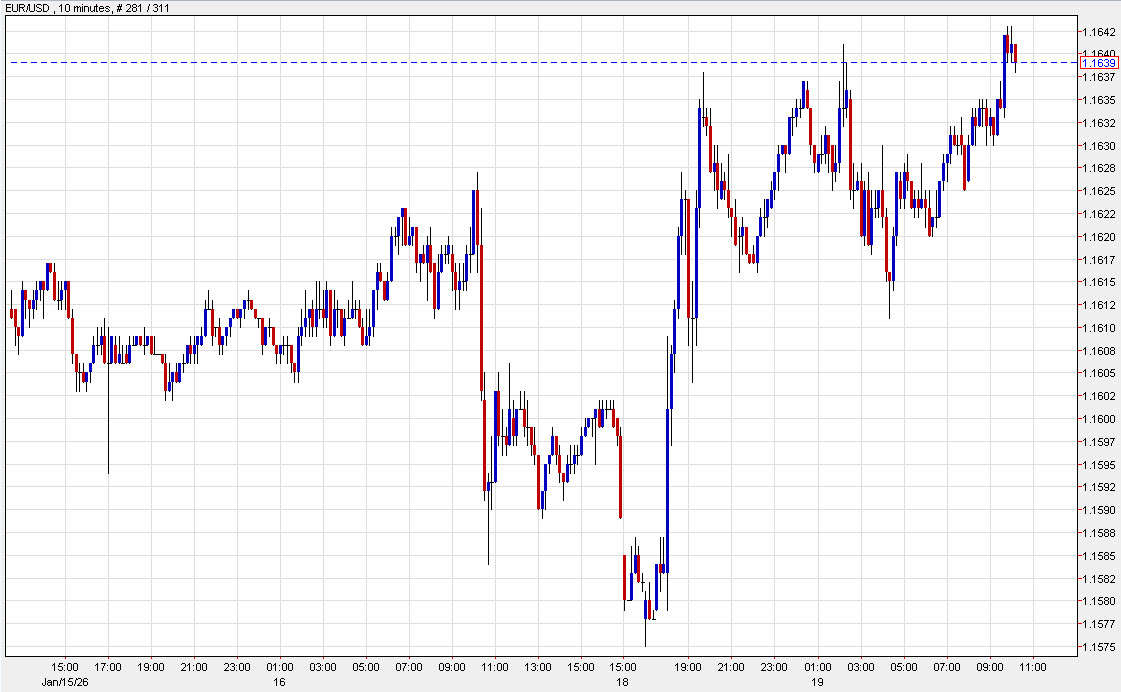

That said, the 40 pip bounce in the euro today only unwinds the selling from Thurs/Fri. The low at the open in the euro was the worst level since November 30.

The two top performers today are telling: The Swiss franc and New Zealand dollar.

The Swiss currency is always a safe haven and its long-term neutrality makes it a go-to haven in times of stress. That said, it's not 1939 anymore and Switzerland can only absorb so much in terms of capital inflows before it resorts to negative rates once again.

New Zealand is more of a geographic safe haven. The pacific island nation is hidden away in an increasingly uncertain world. It also has a strong rule of law and values that attractive to those who would flee.

It's a strange time in markets but that's the trade.