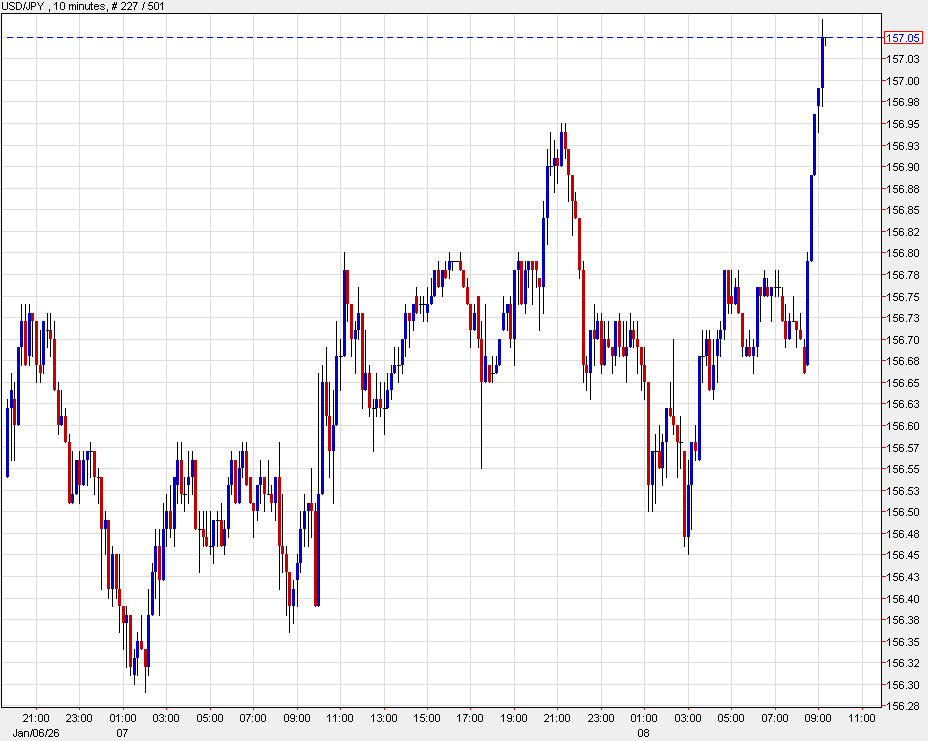

The US dollar reaction immediately after the October trade data was tepid, with about 10 pips of gains in USD/JPY but that's since stretched to 35 pips.

As I highlighted with the data, the trade beat will lead directly to higher GDP forecasts for the fourth quarter. The clearest example of that will be in the Atlanta Fed GDPNow forecast later but Fitch Ratings has revised US growth forecasts upward:

- 2025 GDP growth now estimated at 2.1%versus 1.8% previously

- 2026 growth forecast set at 2.0% versus 1.9% previously

Those aren't exactly "pile into US dollars" numbers but they're a step in the right direction. Note though that the market has been backing away from near-term Fed rate cuts. The odds of a January move are now below 10% and March has fallen from 65% at the start of the year to 43% currently. Part of that is because of the solid ADP number yesterday along with a strong ISM services survey.

Fitch said:

Buoyant equity markets are supporting consumer spending which grew by 0.9% in 3Q25. Consumption has held up surprisingly well despite a slowdown in real household income growth through 2025 as employment growth has weakened. The saving ratio fell from 5.1% of income in January 2025 to 4.0% in September.

A big factor will be tomorrow's non-farm payrolls report. The consensus is +60K but the market might be sniffing out some upside risks. Also keep an eye on the unemployment rate, which is forecast to tick down to 4.5% from 4.6%.

Eyes will also be on the US Supreme Court at 10 am ET on Friday as they've scheduled a 'decision day'. The decision that markets are looking out for is on Trump's tariffs. If they're struck down and tariffs refunded, you could see some big market moves in the aftermath.

As for the US dollar, USD/JPY is the main axis of strength so far but there is a broader USD move with EUR/USD now down 15 pips on the day and at a session low. Cable is also trading down 36 pips to 1.3421.