The US dollar jumped, particularly against the yen after comments from the Treasury Secretary:

- We have a strong dollar policy

- US not intervening in the currency market to support the Japanese yen

- On the Fed, hope they have an open mind

- Miron's term could continue

- Have not narrowed or expanded list of 4 Fed candidates

- Spoke with Trump about Fed chair decision on Tuesday

- No trade deal with South Korea until they ratify

- On Canada, encouraging Carney to do what he thinks is best for Canadians

- USMCA talks are coming up

- On Canada, in the end I think we will end up in a good place

- Trump has sought to bring down the temperature on ICE

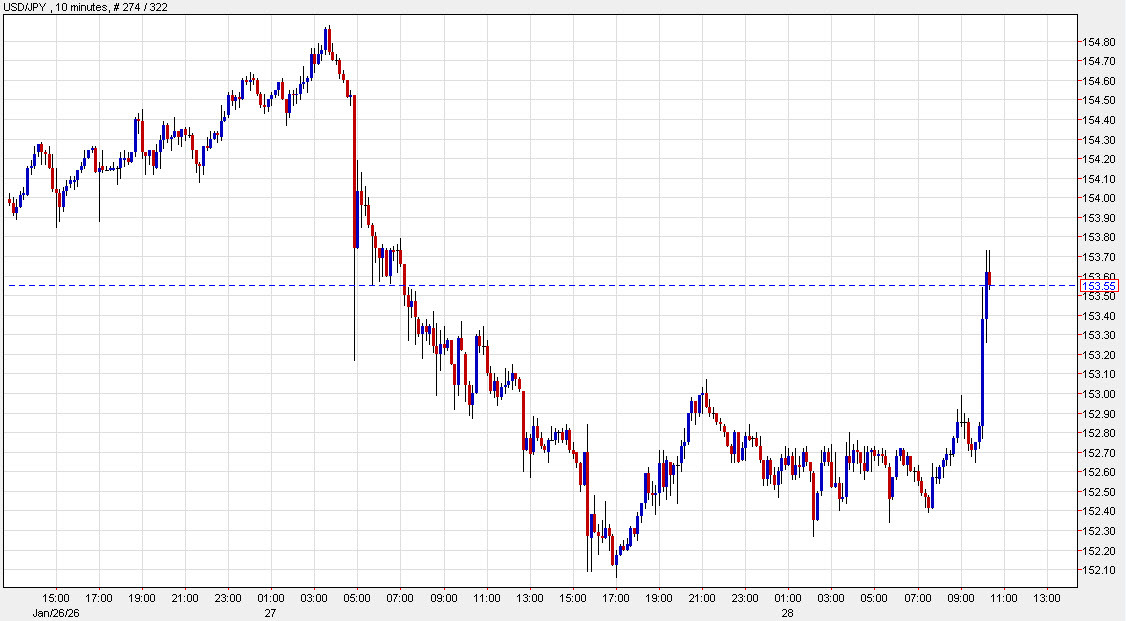

In term of markets, the US dollar rallied on the comments with USD/JPY making the biggest move. It's now up 139 pips to 153.58 on the day.

Yesterday, the US dollar fell to 152.10 on Trump's comments that seemed to endorse the dollar slide. We are now well-above those levels as the rebound has been stronger than the drop.

The dollar fell hard yesterday in general and has recouped some but not all of the selling.

The "strong dollar" policy was formally inaugurated in 1995 under Treasury Secretary Robert Rubin during the Clinton administration. It marked a departure from previous eras where the U.S. occasionally sought a weaker currency to boost exports. Rubin’s mantra—"a strong dollar is in the U.S. national interest"—was designed to attract foreign capital, keep inflation low, and maintain the greenback’s status as the global reserve currency.

For decades, the Treasury maintained this rhetorical stance to reassure global markets of U.S. fiscal stability. While the policy faced criticism from manufacturers who argued it made American goods expensive abroad, it remained a cornerstone of U.S. economic identity until the late 2010s, when the narrative shifted toward a more nuanced, market-determined exchange rate approach but the mantra 'strong dollar policy' continues.