FUNDAMENTAL OVERVIEW

USD:

The US Dollar has been weakening across the board in this first part of the week following Trump’s escalation over Greenland. As a reminder, the US President threatened to impose 10% tariffs starting on February 1 on the UK, France, Germany and a few other European countries unless the U.S. is permitted to buy Greenland. The tariffs will rise to 25% from June 1 in case of no deal.

The main narrative for the greenback’s weakness is once again de-dollarisation due to the messy and aggressive US policies. The current squeeze on recent dollar longs might be more about positioning.

Given the recent USD strength on some slightly hawkish repricing, this latest escalation kind of unwinds those bets. If we were to get a de-escalation now, the US Dollar would probably rally again, and more so if the economic data in the next weeks and months strengthens.

Trump is giving a speech tomorrow at the World Economic Forum in Davos and he will also likely talk about Greenland with the European leaders. We might get headlines or a Trump’s post on Truth Social on the matter, so watch out for any de-escalation or further escalation.

CHF:

On the CHF side, the Swiss Franc is once again surging on the back of the risk-off flows. In terms of monetary policy, nothing has changed. The SNB left everything unchanged at the last meeting and sounded a bit more positive on the future outlook given the lower US tariff rate. SNB’s members continue to repeat that the bar for negative rates remains high, so that leaves the Swiss Franc trading mostly based on risk sentiment.

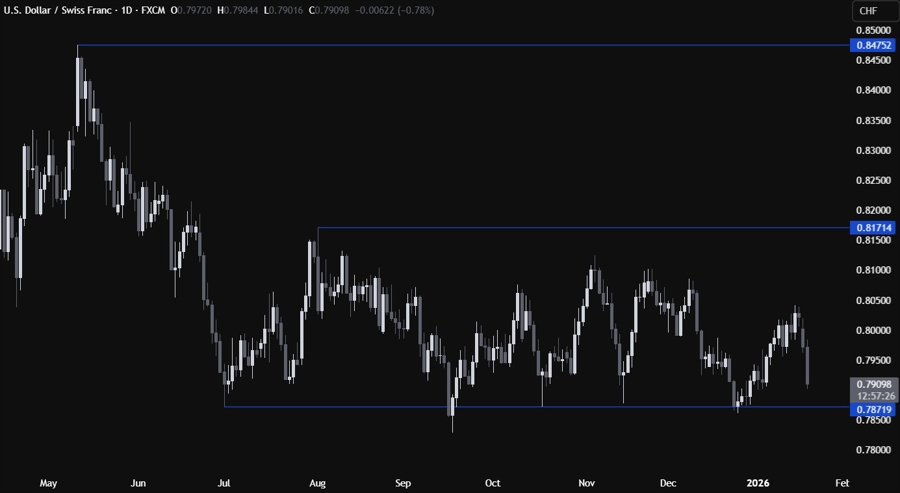

USDCHF TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that USDCHF erased all the January gains in a couple of days on the latest risk-off sentiment. If the price falls further, we can expect the buyers to step in around the key support zone around the 0.7870 level. The sellers, on the other hand, will look for a break lower to increase the bearish bets into new cycle lows.

USDCHF TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see that the price reached a key swing level near the 0.7900 handle. This is where we can expect the first dip-buyers to step in with a defined risk below the level to position for a rally into new highs. The sellers, on the other hand, will look for a break lower to extend the drop into the 0.7870 support next.

USDCHF TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see that the price reached already the lower bound of the average daily range for today. In such cases, we can generally see some consolidation or a pullback. We have a downward trendline defining the bearish momentum on this timeframe. If we get a pullback, we can expect the sellers to lean on the trendline with a defined risk above it to position for a drop into new lows. The buyers, on the other hand, will look for a break higher to increase the bullish bets into new highs.

UPCOMING CATALYSTS

Today we have the weekly US ADP jobs data and the potential US Supreme Court decision on Trump’s tariffs. Tomorrow, we have Trump’s speech at the World Economic Forum in Davos. On Thursday, we get the latest US Jobless Claims figures. On Friday, we have the US Flash PMIs. Watch out for headlines and Trump’s posts on Truth Social regarding Greenland as the market’s focus remains on this latest escalation.