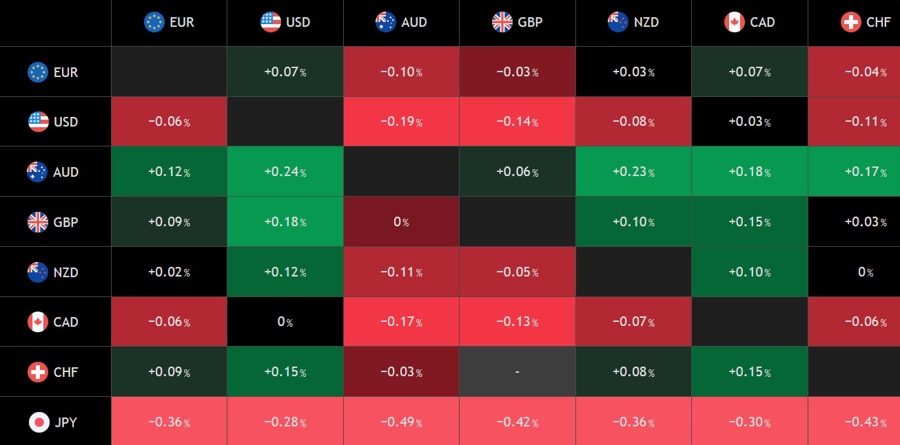

We are seeing the JPY free-falling again across the board today. The Japanese long-term yields continue to hit record highs and that is of course drawing attention from Japanese officials as borrowing costs rise.

Governor Ueda this morning noted that long-term rates have been rising rather rapidly recently and added that the BoJ would increase JGB purchases in case long-term yields make abrupt moves. The last comment is not exactly bullish for the JPY.

Despite the incoming rate hike and constant jawboning from Japanese officials, the JPY remains weak. Part of the problem could be that the BoJ waited far too long and it's now looking to deliver a cautious rate hike right when other major central banks are shifting to a hawkish stance.

The market has also already priced in a rate hike this month and at very least another in 2026, so it's hard to see the BoJ outhawking the market pricing, leaving limited room for JPY appreciation on a hawkish repricing.

As I see it, the JPY is now more at the mercy of other major central banks' stances. For example, if things go south with the US data or a potentially hawkish Fed triggers a risk-off wave, then we could see the JPY gaining some ground as the market will price in more rate cuts further down the curve for the Fed.

Watch out also for Japanese officials stepping up their jawboning with final warnings or even rate checks.