The US dollar is softer following today's data and gold is rebounding.

Here were the numbers:

- US consumer confidence for September 94.2 versus 96.0 expected

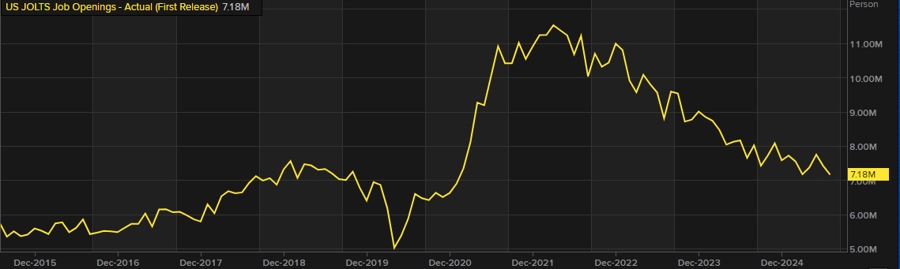

- JOLTS job openings for August 7.227M vs 7.185M estimate

The JOLTS data is the one the market is focused on and it was hot, which should lift the US dollar but the market is looking through the numbers and deciding that a small improvement doesn't jeopardize the likelihood of two more rate cuts this year. We saw a similar market reaction to last week's PCE data, as inflation was slightly hot but the market took it as a 'good enough' sign.

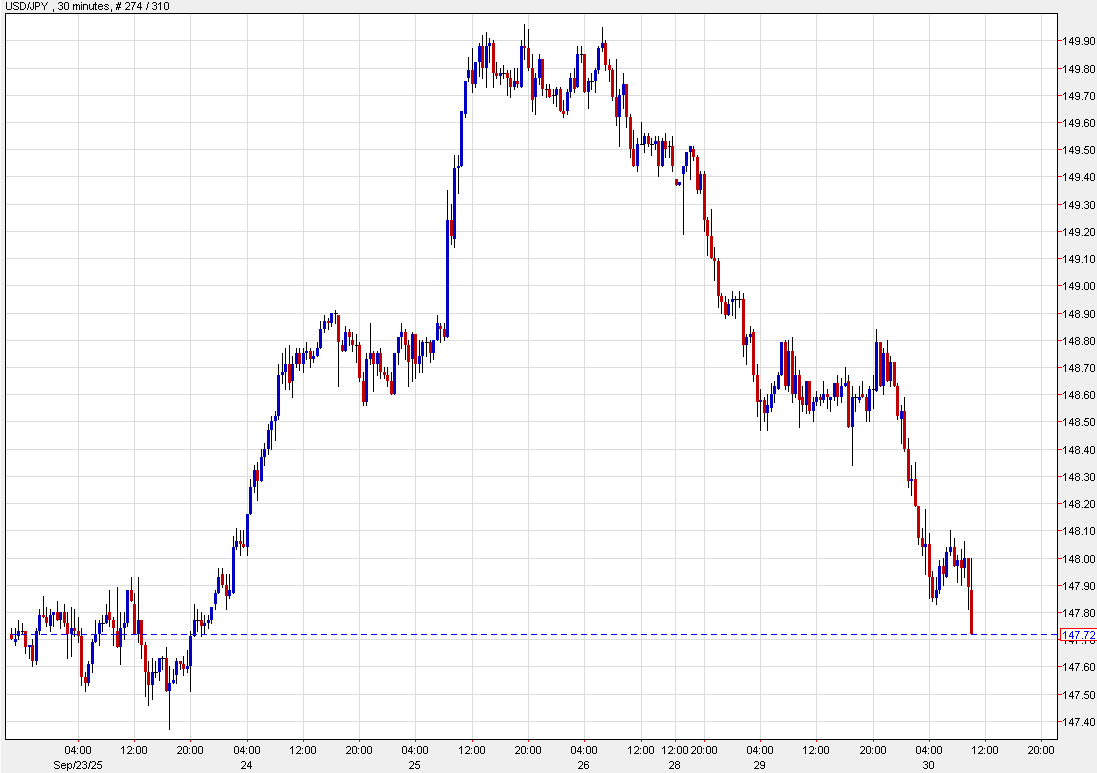

On this data, USD/JPY has fallen to the lows of the day, down 85 pips to 147.71, which essentially completes the round trip from last week.

The euro is also climbing and gold is rapidly recovering from the earlier dip. It's now up $10 on the day to $3845 and only about $30 from the record high.