FUNDAMENTAL OVERVIEW

USD:

The US Dollar has been weakening across the board in this first part of the week following Trump’s escalation over Greenland. The main narrative for the greenback’s weakness is once again de-dollarisation due to the messy and aggressive US policies. The squeeze on recent dollar longs might be more about positioning though.

Given the recent USD strength on some slightly hawkish repricing, this latest escalation kind of unwinds those bets. If we were to get a de-escalation, we would probably see a relief rally in the US Dollar, and more so if the economic data in the next weeks and months strengthens.

Today, all eyes will be on Davos where Trump will be giving a speech at the World Economic Forum and then will hold discussions with leaders about Greenland and other matters. Watch out for headlines or Truth Social posts as they could impact the market in a big way.

AUD:

On the AUD side, the RBA at the last policy decision sounded more hawkish following a series of higher-than-expected inflation reports. The central bank also discussed whether a rate hike might be needed at some point in 2026.

The market is pricing a 29% probability of a rate hike at the upcoming meeting in February with a total of 38 bps of tightening seen by year-end. Tomorrow, we get the Australian employment report, and although the RBA is focusing more on the quarterly inflation report coming next week, the labour market data could still influence the market pricing, especially if we see notable deviations.

Given the hawkish expectations, a soft report will likely have a bigger impact on the AUD. In such a case, we will likely see the AUD weakening across the board. On the other hand, a hot report should keep on supporting the currency amid the hawkish bets.

AUDUSD TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that AUDUSD bounced from the support zone around the 0.6665 level and extended the gains following Trump’s escalation over Greenland. There’s not much we can glean from this timeframe, so we need to zoom in to see some more details.

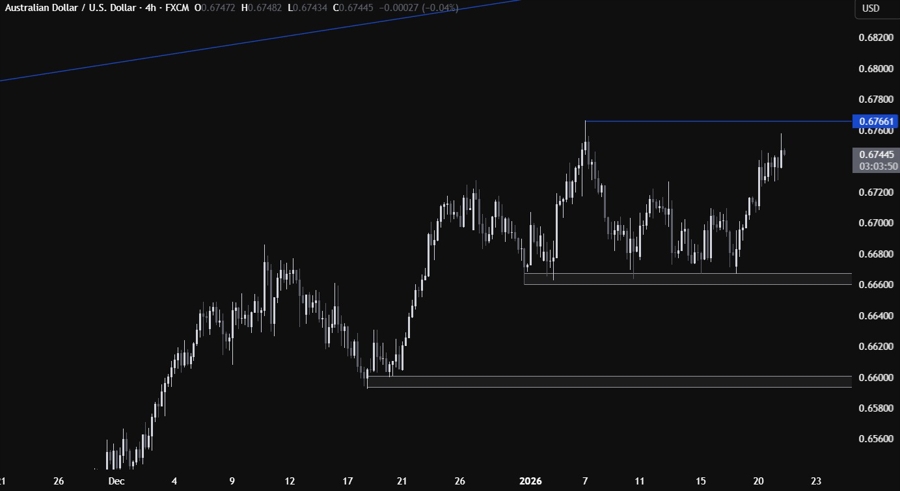

AUDUSD TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see more clearly the rally from the 0.6665 support zone that quickly erased all the January’s dollar gains. From a risk management perspective, the buyers will have a better risk to reward setup around the support to position for a rally into new highs, while the sellers will need a break lower to open the door for a fall into the 0.6600 handle next.

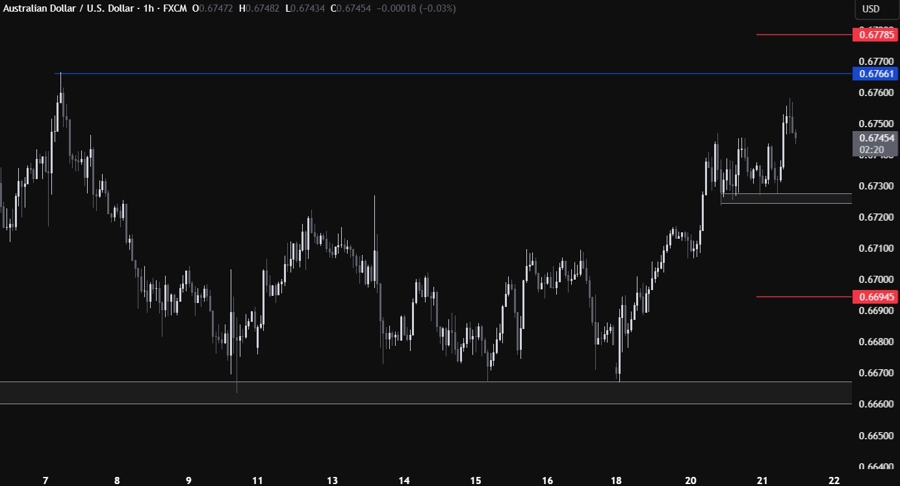

AUDUSD TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see that we have a minor support zone around the 0.6725 level. If the price gets there, we can expect the buyers to step in with a defined risk below the support to position for a rally into new highs. The sellers, on the other hand, will look for a break lower to pile in for a drop back into the 0.6665 support. The red lines define the average daily range for today.

UPCOMING CATALYSTS

Today all eyes will be on Davos where Trump will deliver his speech at the World Economic Forum and then will hold discussions with leaders about Greenland. We have also the Fed’s Cook hearing today at the US Supreme Court. Tomorrow, we get the Australian employment report and the US Jobless Claims figures. On Friday, we conclude the week with the US Flash PMIs.