FUNDAMENTAL OVERVIEW

USD:

The US Dollar had a good run last week on some unwinding of overstretched US Dollar shorts and mostly stronger US data. The bullish momentum eventually faded as we got a very weak US Job Openings report that coupled with the selloff in the stock market weighed on the market pricing. The focus has now turned to the US NFP report on Wednesday as that’s going to be pivotal for the US Dollar.

In fact, the market is pricing 54 bps of easing for the Fed this year, so there’s a high risk of a hawkish repricing in case the data comes out strong. In such a scenario, we will likely see the greenback rallying across the board.

On the other hand, a weak report should strengthen the case for more Fed easing and might even see traders bringing forward rate cut bets as some Fed members expressed scepticism about labour market stabilisation. In that case, the US Dollar will likely come under renewed pressure on dovish Fed bets.

EUR:

On the EUR side, the ECB held interest rates steady as widely expected last week and kept everything unchanged. It was a non-event basically. The focus was mainly on President Lagarde and comments on the euro after it broke through the 1.20 level against the US Dollar.

Lagarde just acknowledged euro's gains since last March and reiterated they don't have an exchange rate target. She added though that a stronger euro could bring inflation down more than expected.

ECB policymakers have been sounding less concerned about the euro after the exchange rate eased to 1.18. The line in the sand remains the 1.20 level but it will need to be followed by softer inflation data to trigger rate cut bets.

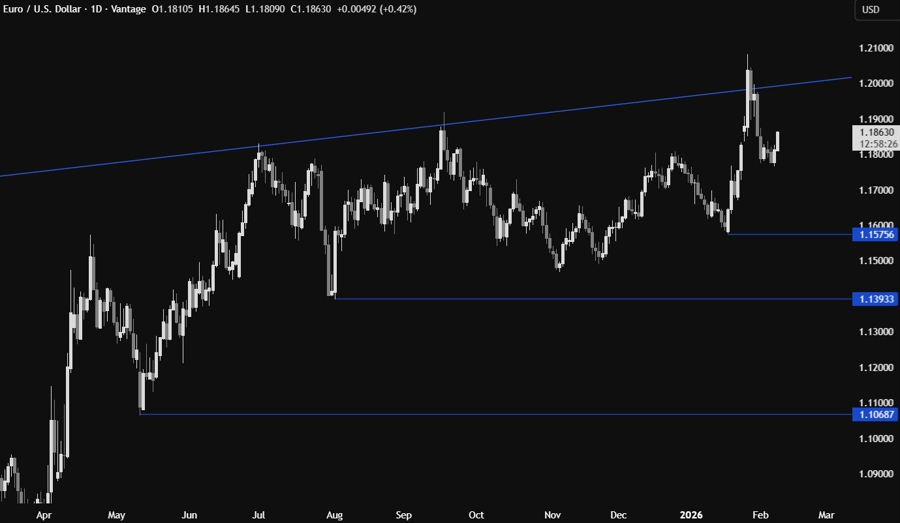

EURUSD TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that EURUSD eased materially after breaking above the 1.20 level as dollar shorts got overstretched and ECB policymakers “jawboned” the euro. If we get another rally into the 1.20 handle, we can expect the sellers to step in around those levels with a defined risk above the cycle high to position for a drop into the 1.1575 level. The buyers, on the other hand, will look for a break higher to increase the bullish bets into new cycle highs.

EURUSD TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see that we have a strong resistance zone around the 1.19 handle. If the price gets there, we can expect the sellers to step in with a defined risk above the resistance to position for a drop back into the 1.1760 support targeting a breakout. The buyers, on the other hand, will look for a break higher to increase the bullish bets into a new cycle high next.

EURUSD TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see we have a minor upward trendline defining the bullish momentum on this timeframe. The buyers will likely continue to lean on the trendline to keep pushing into new highs, while the sellers will look for a break lower to pile in for a drop back into the 1.1760 support. The red line define the average daily range for today.

UPCOMING CATALYSTS

Tomorrow we get the US December Retail Sales and the US Employment Cost Index data. On Wednesday, we have the US NFP report. On Thursday, we get the US Jobless Claims figures. On Friday, we conclude the week with the Eurozone Flash Q4 GDP and the US CPI report.