The US dollar is the G10 laggard today by a long shot. It's a sharp move lower after some signs of life last week. What's behind the dollar selling:

1) Jobs

Last week we got five numbers that all pointed to a weakening of the US jobs picture:

- ADP employment

- ISM services employment component

- Initial jobless claims

- Challenger job cuts

- JOLTS

That all came ahead of Wednesday's non-farm payrolls report and the consensus is +70K. That certainly sounds on the high side compared to the data we've seen so far. Jobs are a critical focus of the FOMC and even one weak number will tilt them closer to cutting.

2) Jobs revisions

In September, the preliminary benchmark revision for the April 2024-2025 period saw 911K jobs trimmed. More recently, Federal Reserve Chairman Jerome Powell estimated a decrease of 600,000 to employment rolls in the January benchmark revision. There's talk it could be significantly higher than that and even if the number is 'in line' it will be a reminder that little good is happening in US employment.

To that point, 93% of US jobs in the past three years have been in just three sectors – leisure & hospitality, government and private education and healthcare services. It's hard to imagine those will continue to remain sources of strength.

3) Valuations

There is a broad re-think of valuations underway. For many years, software companies (dominated by US names) have received premium valuations while old industrial names lagged. There is a re-think underway that highlights the possibility that software names are disrupted by AI while old industrial and stodgy companies use AI to improve margins. That's led to a reversal in that trade and leading people to find value outside of the USA.

4) The dollar debasement trade

There are a few things that are working together on this, including US tariffs and the breakdown in the global order, along with the weaponization of the financial system. That's a long-term headwind that's going to have ebbs and flows but the report today about China telling financials to cut Treasury holdings speaks to the trend. Of course, gold and silver are bid once again.

5) Volatility cooling

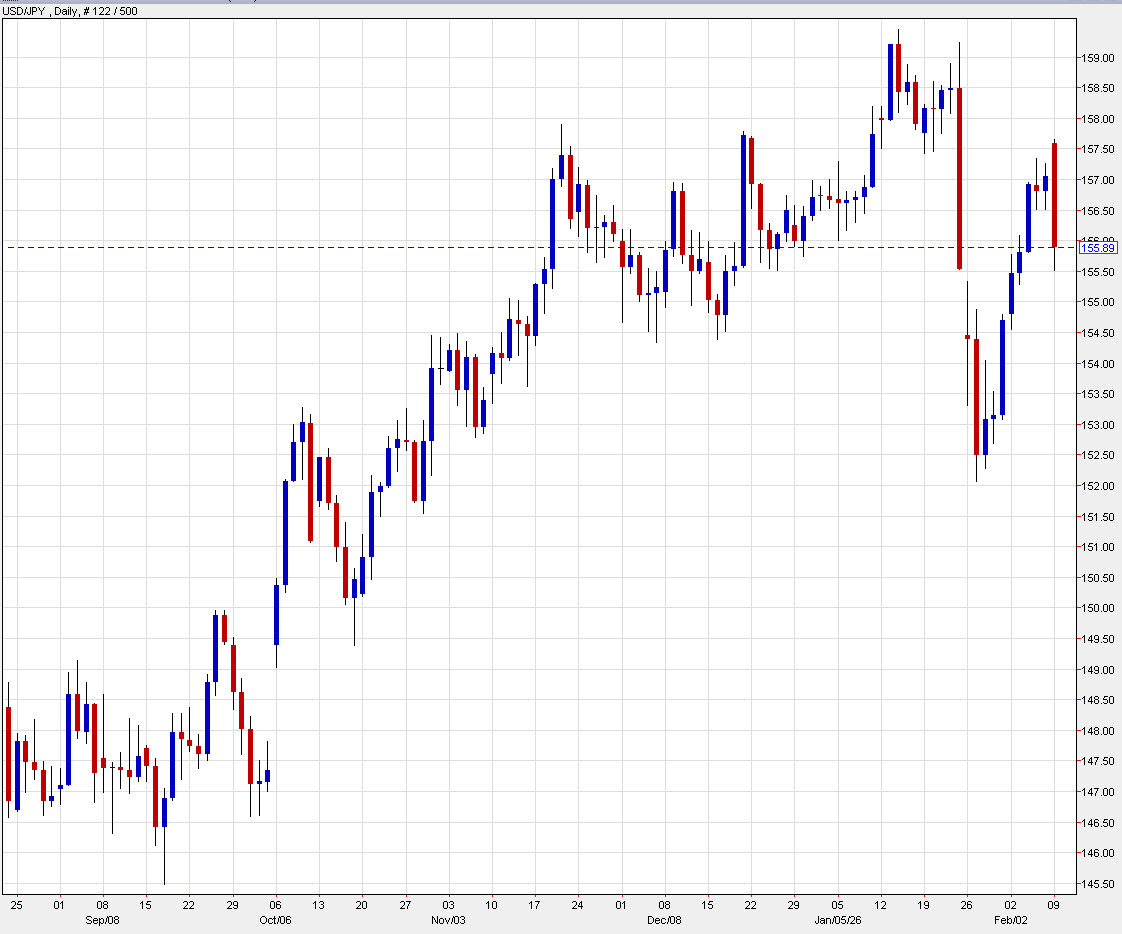

The volatility got so high last week that it led to dollar bids. With markets cooling down today, we're seeing some of that unwind and money drift out of dollars. A lot of that also runs through the yen, where the election results have given Takaichi a strong hand and led to threats of intervention that I wouldn't dismiss out of hand.