FUNDAMENTAL OVERVIEW

USD:

The US Dollar weakened across the board to start the week following Trump’s escalation over Greenland. In fact, the US President threatened to impose 10% tariffs starting on February 1 on the UK, France, Germany and a few other European countries unless the U.S. is permitted to buy Greenland. The tariffs will rise to 25% from June 1 in case of no deal.

As seen last year, risk-off moves caused by Trump’s tariffs stemmed from growth worries. Growth worries trigger a selloff in the stock market and in turn a fall in Treasury yields on expected future weakness in the economy. This in turn weighs on the greenback on expected earlier or larger rate cuts down the road.

This is always taken in relation to the expectations. Given the recent rally in the USD on some slightly hawkish repricing, this latest escalation kind of unwinds those bets. If we were to get a de-escalation now, the US Dollar would probably rally again, and more so if the economic data in the next weeks and months strengthens.

EUR:

On the EUR side, the threat of tariffs on the largest European economies isn’t good news of course, but given the recent positioning, it weighed more on the greenback. The Fed has also much more room to cut rates compared to the ECB, which has already reached the neutral level and has inflation at target.

In terms of monetary policy, the ECB remains in a neutral stance reaffirming its data-dependent and meeting-by-meeting approach to policy decisions. ECB members continue to repeat that the current policy is appropriate, and they won’t respond to small or short-term deviations from their 2% target. The data has been supporting the central bank’s neutral stance, with inflation data recently surprising to the downside.

EURUSD TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that EURUSD opened lower today but eventually closed the gap and extended the gains into the downward trendline. We can expect the sellers to step in around these levels with a defined risk above the trendline to position for a drop into the 1.15 handle. The buyers, on the other hand, will want to see the price breaking higher to pile in for a rally into the 1.18 level next.

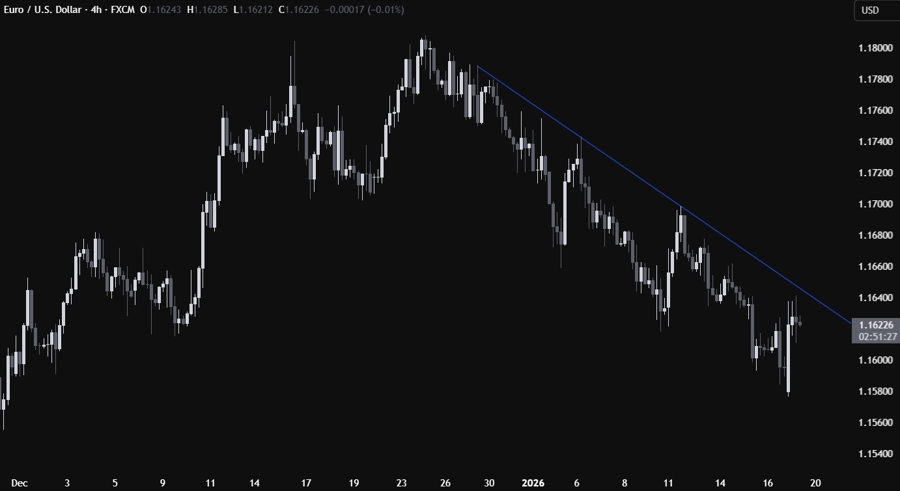

EURUSD TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see more clearly today’s price action with the pair struggling to extend the gains near the trendline. There’s not much we can add here as the sellers will look for short opportunities around these levels with a defined risk above the trendline, while the buyers will wait for a break above the trendline to start targeting new highs.

EURUSD TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see that the price is trading at the upper bound of the average daily range for today. This suggests that we might not see much more upside today and the price could either consolidate here or pull back.

There’s a minor support zone around the 1.16 handle. If the price gets there, we can expect the buyers to step in with a defined risk below the support to position for a break above the trendline. The sellers, on the other hand, will look for a break lower to increase the bearish bets into new lows.

UPCOMING CATALYSTS

Tomorrow we have the weekly US ADP jobs data. On Thursday, we get the latest US Jobless Claims figures. On Friday, we have the Eurozone and US Flash PMIs. Watch out also for headlines and Trump’s posts on Truth Social regarding Greenland as the market’s focus remains on this latest trade war.